Trade Alert - (FB) November 9, 2016

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (FB)- TAKE PROFITS

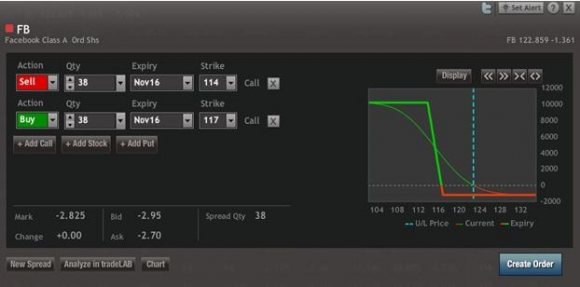

SELL the Facebook (FB) November, 2016 $114-$117 in-the-money vertical bull call spread at $2.82 or best

Closing Trade

11-9-2016

Expiration Date: November 18, 2016

Portfolio Weighting: 10%

Number of Contracts = 38 contracts

I believe that with the election of Donald Trump as President, and the Republican sweep of the Senate, the House of Representatives and the Supreme Court, we are looking at nothing less than a New World Order.

The trading and investment implications of this are nothing less than momentous.

The bottom line is that a radical realignment of your portfolio is urgently required.

You can sum it up as this:

OUT WITH THE NEW ECONOMY AND IN WITH THE OLD ECONOMY.

This is not a day trade, a week trade, or even a month trade. It is a major new trend that could last for the rest of the decade.

So for that reason, I am taking profits in my position in the Facebook (FB) November, 2016 $114-$117 in-the-money vertical bull call spread at $2.82.

It was my original plan to hold this position seven more trading days to the November 18th expiration and run it up to its maximum potential value of $3.00.

But, given the violence of the moves in financial assets these days, I am bailing out right here, right now.

In any case, earning a welcome 9.72% profit in only two trading days is better than a poke in the eye with a sharp stick. No one ever got fired for taking a profit.

Big tech is about to get slammed, and I don?t want to be anywhere near it when that happens.

This leaves me coming out of the ?Amerexit? overnight flash crash and subsequent melt up with my trading performance at another new all time high. We are now annualizing well over 37% a year.

If you are uncertain about how to execute this options spread, please watch my training video ?How to Execute a Vertical Bull Call Spread?

Please keep in mind these are ballpark prices at best. After the text alerts go out, prices can be all over the map. There is no telling how much the market will have moved by the time you get this email.

Paid subscribers, be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's volatile markets, individual investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.? The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 7 days to expiration.

Here Are the Specific Trades You Need to Execute This Position:

Sell 38 November, 2016 (FB) $114 calls at??.?.??$10.40

Buy to cover short 38 November, 2016 (FB) $117 calls a?.$7.58

Net Proceeds:?????????????????......$2.82

Profit: $2.82 - $2.57 = $0.25

(38 X 100 X $0.25) = $950 or 9.72% profit in 2 trading days.