Trade Alert - (FCX) April 21, 2022 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (FCX) – BUY

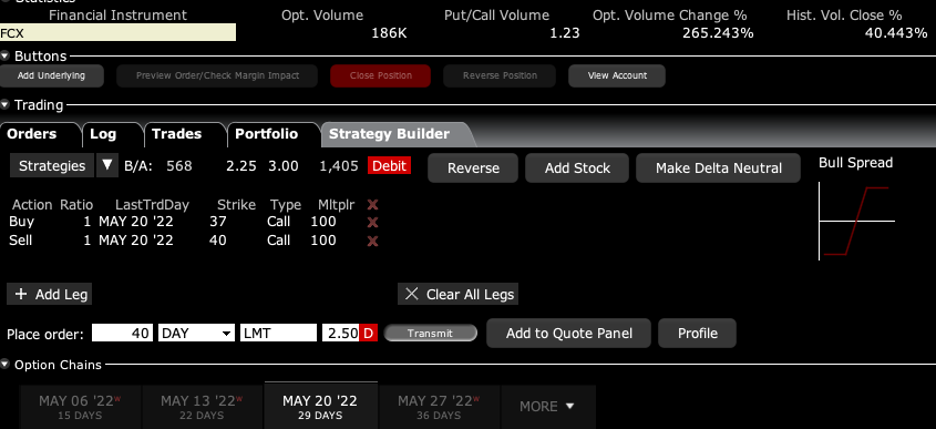

BUY the Freeport McMoRan (FCX) May 2022 $37-$40 vertical BULL CALL spread at $2.50 or best

Opening Trade

4-21-2022

expiration date: May 20, 2022

Portfolio weighting: 10%

Number of Contracts = 40 contracts

Finally, we got a decent entry point for a position in the midst of a long-term structural bull market.

If you can’t do options, buy the stock. My long-term target for (FCX) is $100, up from today’s $44.84. (FCX) is the world’s largest copper producer.

Freeport McMoRan announced fabulous earnings today, and the stock promptly sold off 9%. It was a classic buy the rumor, sell the news type move. This is despite the fact that the United States Copper Fund ETF (CPER), in which (FCX) is a major holding, is up on the day.

Please remember that I told you earlier that each Tesla needs 200 pounds of copper, that Tesla sales could double to 2 million this year, and that they could sell 4 million if they could make them.

Today’s selloff was triggered by cautious forecasts that copper demand in China, the world’s largest copper consumer, is fading. This is due to the Shanghai covid lockdown, which is temporary at best.

Therefore, I am buying the Freeport McMoRan (FCX) May $37-$40 vertical BULL CALL spread at $2.50 or best.

Don’t pay for than $2.70 or you will be chasing.

This trade also has the benefit in that you have massive support on the charts at the 200-day moving average at $39.63.

Freeport McMoRan reported net income that more than doubled to an eye-popping $1.53 billion, or $1.04 a share, from $718 million, or 48 cents a share, in the year-ago period. Excluding nonrecurring items, adjusted earnings per share of $1.07 beat the FactSet consensus of 94 cents.

Revenue grew 36.1% to $6.60 billion, above the FactSet consensus of $6.44 billion, as copper sales rose 24.1% to 1.02 billion recoverable pounds and as gold sales increased 58.5% to 409,000 recoverable ounces.

Average realized price per pound of copper rose 18.2% to $4.66 and the realized price per ounce of gold increased 12.1% to $1,920. The company cut its copper sales outlook for the second quarter to 1.040 billion pounds from 1.075 billion pounds, for the third quarter to 1.095 billion pounds from 1.125 billion pounds and for the fourth quarter to 1.095 billion pounds from 1.130 billion pounds.

This is a bet that the (FCX) will not rise fall below $40.00 by the May 20 options expiration in 21 trading days.

If you are looking for other copper plays, please take a look at the United States Copper Fund (CPER), First Quantum Minerals Ltd. (FM.TO), Antofagasta (ANTO.L), hang on. We are going much higher.

I have a feeling that Freeport McMoRan is my new rich uncle, cutting me generous maintenance checks every month.

Here are the specific trades you need to execute this position:

Buy 40 May 2022 (FCX) $37 calls at………….………$8.00

Sell short 40 May 2022 (FCX) $40 calls at…………$5.50

Net Cost:………………………….………..…………...….....$2.50

Potential Profit: $3.00 - $2.50 = $0.50

(40 X 100 X $0.50) = $2,000 or 20.00% in 21 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.