Trade Alert - (FCX) July 19, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (FCX) – BUY

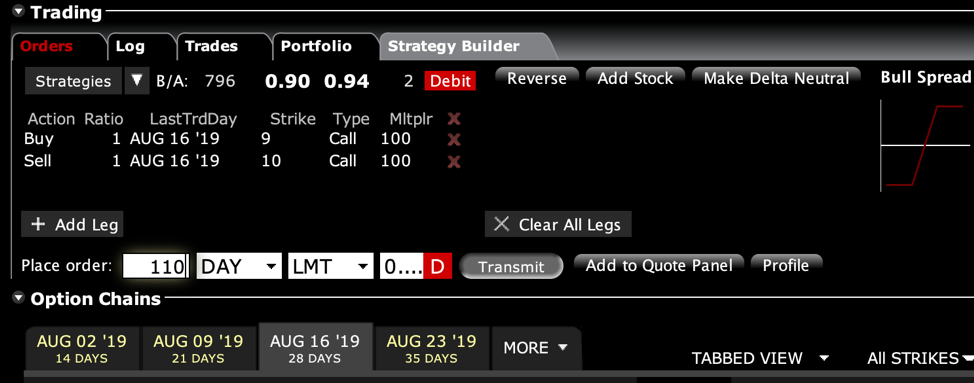

BUY the Freeport McMoRan (FCX) August 2019 $9-$10 vertical BULL CALL spread at $0.90 up to $0.93

Opening Trade

7-19-2019

expiration date: August 16, 2019

Portfolio weighting: 10%

Number of Contracts = 110 contracts

With a series of US interest rate cuts coming closer by the day, I am casting a wider net for weak dollar plays. Gold has already run too much, but copper is looking very interesting with a major upside breakout underway on the charts.

There is a great entry point here for the red metal, with copper having just completed a robust 13.33% correction and Freeport McMoRan (FCX) with a 35.6% pullback in its rear view mirror.

Therefore, I am buying the Freeport McMoRan (FCX) August 2019 $9-$10 vertical BULL CALL spread at $0.90 or best.

Don’t pay for than $0.93 or you will be chasing. If you can’t get my price, then wait for a pullback to get in.

If you don’t do options, buy the (FCX) shares outright. There is a potential double in these shares from this level over the long term.

This is a bet that the (FCX) will not fall below $10.00 by the August 16 option expiration in 20 trading days.

There’s nothing like getting in on the ground floor of a raging bull market in commodities to get your juices flowing, even for a senior citizen.

That’s why I am jumping into the Freeport McMoRan (FCX) right here and right now. (FCX) is the world’s largest producer of copper.

Many thanks to my many subscribers who work at Freeport, although I assure you, you had absolutely nothing to do with the recent move in your stock.

This is inspired by the fact that prices for the red metal have recently broken out of a major long term bottom.

Instead, there is a parade of people I wish to thank for the opportunity presented by this trade.

First, I have to tip my hat to Federal Reserve Chairman, Jay Powell, for making it abundantly clear to me on countless occasions that he has strongly hinted he will cut interest rates this year. This will knock the wind out of the greenback, and given newfound strength to commodity stocks like (FCX).

Hey, Jay, call me!

I also want to thank the government in Beijing for the assist, which announced a major program to stimulate the Chinese economy through the reduction of bank reserve requirements.

China is the world’s largest consumer of copper, and a stronger economy consumes more of the red metal, boosting prices northward.

I owe you all a Peking duck dinner for this one. Might I suggest the Da Dong Roast Duck Restaurant on Dongsi on the 10th Alley in Beijing? They’re supposed to be the best in town.

Finally, one can’t ignore the contribution of the Houthi rebels in Yemen for inspiring a sharp rally in the price of crude oil (USO), which helped drag up the price of other commodity stocks as well, including those producing copper.

For you I owe a round of falafels and cooked sheep’s eyes, favorites of yours, I know. However, I’ll have to mail this one in, lest a CIA Predator drone strikes take me out over dinner.

When it rains, it pours.

If instead of buying the (FCX) call spread, you can also purchase the shares outright, the United States Copper Fund (CPER), First Quantum Minerals Ltd. (FM.TO), Antofagasta (ANTO.L), hang on. We are going much higher.

If the Chinese economic recovery is real, as the stock market there seems to think, you can easily double that target.

I have a feeling that Freeport McMoRan is my new rich uncle, cutting me generous maintenance checks every month.

Here are the specific trades you need to execute this position:

Buy 110 August 2019 (FCX) $9 calls at………….………$2.66

Sell short 110 August 2019 (FCX) $10 calls at…………$1.76

Net Cost:………………………….….....……..………….….....$0.90

Potential Profit: $1.00 - $0.90 = $0.10

(110 X 100 X $0.10) = $1,100 or 11.11% in 20 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.