Trade Alert - (FCX) June 2, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (FCX) – BUY

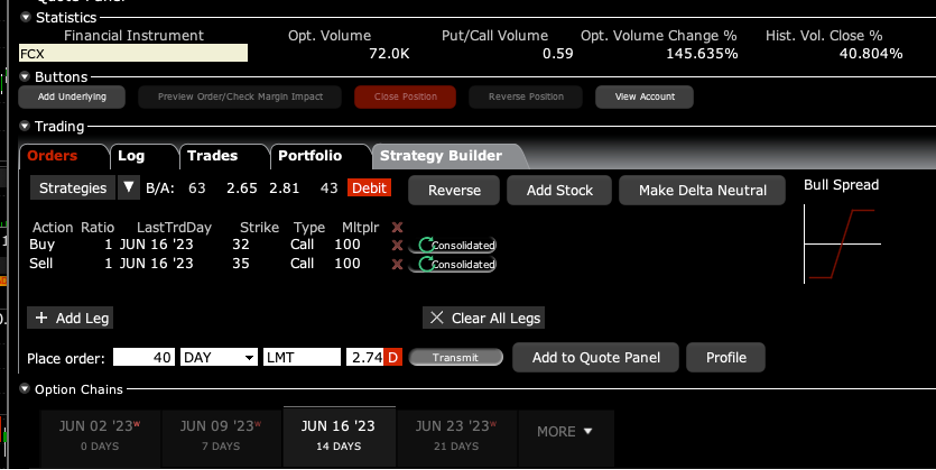

BUY the Freeport McMoRan (FCX) June $32-$35 vertical BULL CALL spread at $2.65 or best

Opening Trade

6-2-2023

expiration date: June 16, 2023

Portfolio weighting: 10%

Number of Contracts = 40 contracts

The debt ceiling has been raised by $4 trillion, inflation is falling, interest rate cuts are ahead, so happy days are here again.

The domestic China-dependent commodity sectors of the economy, in the doghouse all year, is about to move back into the spotlight.

A severe short squeeze in copper is developing, leading to a massive price spike later in 2023. Copper prices could jump from the current $9,000 per metric tonne to $15,000 by December, say industry insiders.

Therefore, I am buying the Freeport McMoRan (FCX) June $32-$35 vertical BULL CALL spread at $2.65 or best.

Don’t pay more than $2.70 or you will be chasing.

A Chinese economic recovery and exploding EV growth are the reasons. Copper is down this year on recession fears.

I believe the fundamental argument for Freeport McMoRan is so compelling that I am going to dive in, even though the Volatility Index ($VIX) is at a miserable $14 handle, a two-year low.

If you can’t do options buy the stock. My long-term target for (FCX) is $100, up from today’s $37.47. (FCX) is the world’s largest copper producer.

Please remember what I told you earlier that each Tesla needs 200 pounds of copper, that Tesla sales could reach 2 million vehicles this year, and that they could sell 4 million if they could make them. The ten-year target is 20 million cars a year.

This is a bet that the (FCX) will not fall below $35.00 by the June 16 option expiration in 10 trading days.

If you are looking for other copper plays, please take a look at the United States Copper Fund (CPER), First Quantum Minerals Ltd. (FM.TO), Antofagasta (ANTO.L), hang on. We are going much higher once the stock market bottoms.

I have a feeling that Freeport McMoRan is my new rich uncle, cutting me generous but undeserved maintenance checks every month.

Here are the specific trades you need to execute this position:

Buy 40 June 2023 (FCX) $32 calls at………….………$5.50

Sell short 40 June 2023 (FCX) $35 calls at…….……$2.85

Net Cost:……………...…………….………..………….….....$2.65

Potential Profit: $3.00 - $2.65 = $0.35

(40 X 100 X $0.35) = $1,400 or 16.00% in 10 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.