Trade Alert - (FXE) December 14, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (FXE)- SELL-STOP LOSS

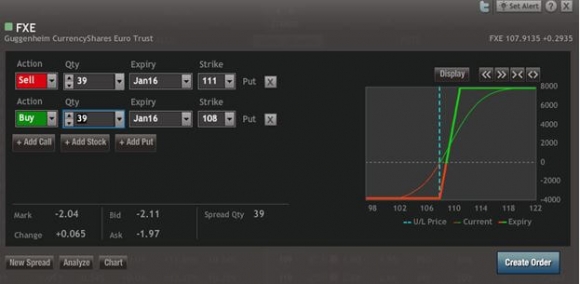

SELL the Currency Shares Euro Trust (FXE) January, 2016 $108-$111 in-the-money vertical bear put spread at $2.04 or best

Closing Trade

12-14-2015

expiration date: January 15, 2016

Portfolio weighting: 10%

Number of Contracts = 39 contracts

All asset classes are currently trading against their long-term fundamentals.

This was triggered by the energy crash and has spilled over into junk bonds.

The bottom line is that the markets are giving us a very bad ending to a miserable year.

So I am going to stay very strict with my 2% stop loss rule and take the hit on the Currency Shares Euro Trust (FXE) January, 2016 $108-$111 in-the-money vertical bear put spread.

If you own the ProShares Ultra Short Euro ETF (EUO) outright, I would keep it. Markets will almost certainly return to their fundamentals next year, or even after the Fed?s Wednesday interest rate hike.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/ .

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

If the price of this spread has moved more than 5% by the time you receive this Trade Alert, don?t chase it. Wait for the next one. There are plenty of fish in the sea.

Here are the specific trades you need to execute this position:

SELL 39 January, 2016 (FXE) $111 puts at?????$3.40

Buy to cover short 39 January, 2016 (FXE) $108 puts at..?.$1.36

Net Cost:??????????????????.....$2.04

Profit at expiration: $2.55 - $2.04 = $0.51

(39 X 100 X $0.51 ) = $1,989 or 1.99% profit for the notional $100,000 portfolio.