Trade Alert - (FXY) August 19, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (FXY) ? TAKE PROFITS

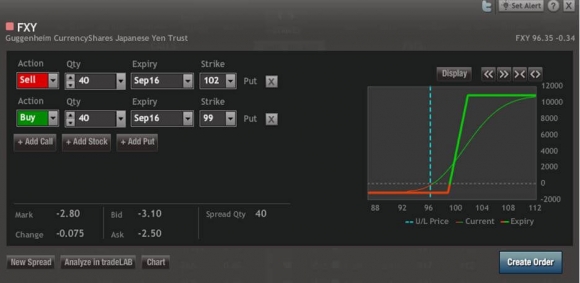

SELL the Currency Shares Japanese Yen Trust (FXY) September, 2016 $99-$102 in-the-money vertical bear put spread at $2.80 or best

8-19-2016

Closing Trade

expiration date: September 16, 2016

Portfolio weighting: 10%

Number of Contracts: 40

The rule for 2016 seems to be to stick to short term trading, the ranges in virtually all asset classes too small to do otherwise.

So I am going to take a quickie one week profit in my Currency Shares Japanese Yen Trust (FXY) September, 2016 $99-$102 in-the-money vertical bear put spread.

Coming out at this price, I am able to lock in a nice 12% gain in just five trading days. That allows us to realize 60% of the potential profit in this position.

My other position in the Currency Shares Japanese Yen Trust (FXY) August, 2016 $97-$100 in-the-money vertical bear put spread expires at the close today, taking me 100% into cash.

We are nearly one point in the money on this one, which should be enough of a cushion to take us to the 4:00 PM EST close.

The long-term fundamentals for the Japanese yen are horrendous. However, the momentum is upward, and I don?t want to spend another month fighting a position when the market is against me.

Better to live to fight another day.

If you have the ProShares Ultra Short Yen ETF (YCS) outright keep it. The yen is going much lower.

The best execution for the options can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options trade, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

Don?t execute the legs individually or you will end up losing much of your profit.

Keep in mind that these are ballpark prices only.

Here are the specific trades you need to execute this position:

SELL 40 September, 2016 (FXY) $102 puts at???..??$5.85

BUY to cover short 40 September, 2016 (FXY) $99 puts ?..$3.05

Cost:????????????.???????.?.....$2.80

Potential Profit: $2.80 - $2.50 = $0.30

(40 X 100 X $0.30) = $1,200 or 12% profit in 5 trading days.