Trade Alert - (FXY) August 4, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (FXY)-Buy

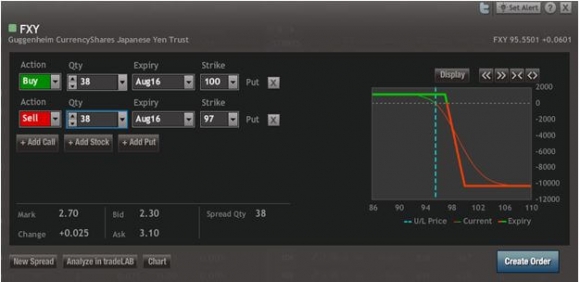

Buy the Currency Shares Japanese Yen Trust (FXY) August, 2016 $97-$100 in-the-money vertical bear put spread at $2.70 or best

Opening Trade

8-4-2016

expiration date: August 19, 2016

Portfolio weighting: 10%

Number of Contracts = 38 contracts

This is a bet that the Japanese yen is not going to blast through to a new multiyear high over the next ten trading days.

It is much more likely that the yen is double topping here on the charts, presaging a much larger move down.

We have had a series of big disappointments from the Tokyo government over the past two weeks that have driven the (FXY) up a monster six points, a huge move in the foreign exchange markets.

First, the Bank of Japan failed to increase quantitative easing at their last meeting. Then the Abe government introduced a reflationary infrastructure package of $275 billion that was seen by the market as too little too late.

In this volatile, unpredictable world, I am only willing to go out only 11 days on such a bet, especially the day before the release of the July nonfarm payroll. If you want to be more aggressive, go out to the September expiration.

If this is your first trade with the Mad Hedge Fund Trader, you may want to pass. (FXY) options are notoriously illiquid during US trading hours.

You have to just put your limit order in the market and wait. If you get your price, fine. If not, walk away. Chasing is NOT allowed here.

If you can?t trade options, then buy the ProShares Ultra Short Yen ETF (YCS) outright keep it. The yen is going much lower.

The best execution for the options can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options trade, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

Don?t execute the legs individually or you will end up losing much of your profit. Keep in mind that these are ballpark prices only.

Spread pricing can be very volatile, and the liquidity in the options market isn?t that great these days. If you can?t get done at the $2.70 price, then keep raising your bid in 5-cent increments until you succeed. If that doesn?t work, then just walk away.

More depth on the Japanese yen to follow.

Here are the specific trades you need to execute this position:

Buy 38 August, 2016 (FXY) $100 puts at?????..??$4.55

Sell short 38 August, 2016 (FXY) $97 puts at..????..$1.85

Cost:????????????.???????.?.....$2.70

Potential Profit: $3.00 - $2.70 = $0.30

(38 X 100 X $0.30) = $1,140 or 11.11% profit in 11 trading days.

?

?