Trade Alert - (FXY) Expiration August 22, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

?

Trade Alert - (FXY) - EXPIRATION

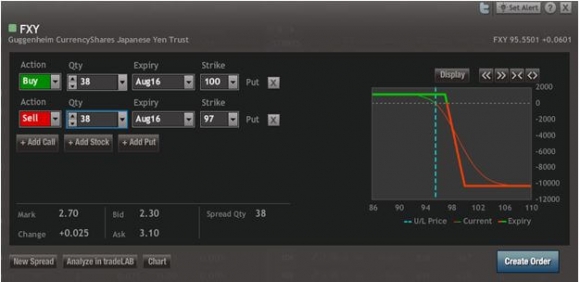

CLOSE the Currency Shares Japanese Yen Trust (FXY) August, 2016 $97-$100 in-the-money vertical bear put spread at $3.00

Closing Trade

8-22-2016

expiration date: August 19, 2016

Portfolio weighting: 10%

Number of Contracts = 38 contracts

The Japanese yen cooperated nicely with my prediction that it would not blast through to a new multiyear high in 12 trading days.

The selloff we got on the Friday expiration down to $96.50 was just the icing on the cake, giving us room to spare on the $97 strike price. The (FXY) closed at $96.50 on Friday.

This was a bet that the Japanese yen would close below $97.00 on August 19.

As a result, we have been able to cash in on 100% of the maximum profit potential and an 11.11% profit in just 12 trading days.

This close makes six out of seven Trade Alerts in a row that have been profitable for my subscribers.

You have nothing to do here. Your long $100 put should have been automatically exercised by your brokers to cover your short in the $97 put.

Well done, and on to the next trade.

I think the yen is rolling over here, so I am inclined to sell short into the next rally. If you bought YCS, hold onto it as I think the yen has much further to fall.

If you are uncertain on how to execute an options trade, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

Here are the specific trades you need to execute this position:

Close 38 long August, 2016 (FXY) $100 puts at?????$3.50

Close short 38 August, 2016 (FXY) $97 puts at..????..-$0.50

Cost:????????????.???????.??.....$3.00

Profit: $3.00 - $2.70 = $0.30

(38 X 100 X $0.30) = $1,140 or 11.11% profit in 12 trading days.