Trade Alert - (FXY) June 9, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (FXY)-STOP LOSS

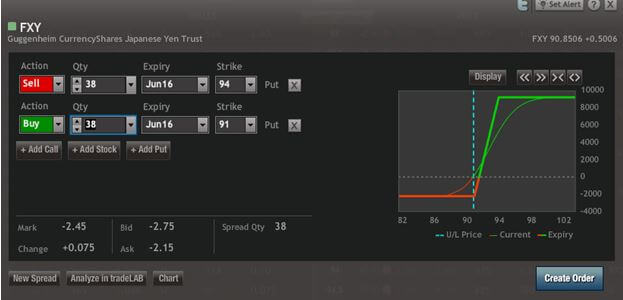

SELL the Currency Shares Japanese Yen Trust (FXY) June, 2016 $91-$94 in-the-money vertical bear put spread at $2.45 or best

Closing Trade

6-9-2016

expiration date: June 17, 2016

Portfolio weighting: 10%

Number of Contracts = 38 contracts

I think they are going to press the dollar all the way until the Federal Reserve Open Market Committee meeting on Wednesday next week.

I am therefore stopping out of my position in the Currency Shares Japanese Yen Trust (FXY) May, 2016 $91-$94 in-the-money vertical bear put spread with a small loss.

With only six days until expiration the risk/reward of keeping it are no longer favorable. The (FXY) is too close to the $91 strike price. In these ratchety, violent, illiquid trading conditions, when things go wrong, they go wrong big.

I am therefore headed for the sidelines.

We had a nice 11% profit in this position only eight trading days. But in this market you get punished for not taking the easy money. Don?t let profits grow hair on them, or they may vaporize instantly.

The recent economic data from Japan continues to dramatically deteriorate, with May machine tool orders falling off a cliff last night, down an eye popping 11%. That should cause the yen to weaken.

But in this upside down looking glass world bad data is seen as increasing the probability that the government will do more to stimulate the economy, which is yen positive.

If you have the ProShares Ultra Short Yen ETF (YCS), take profits for the short term, but keep it for the long term. I think we are going much lower. I?ll wait for a better entry point. The lower leverage in this position will allow you to stand the short term heat.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options trade, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

Don?t execute the legs individually or you will end up losing much of your profit. Keep in mind that these are ballpark prices only.

Here are the specific trades you need to execute this position:

SELL 38 June, 2016 (FXY) $94 puts at?????..??$3.35

Buy to cover short 38 June, 2016 (FXY) $91 puts at.?..$0.90

Proceeds:??????????.???????.....$2.45

LOSS: $2.65 - $2.45 = -$0.20

(38 X 100 X -$0.20) = -$760 or -7.54% loss.