Trade Alert - (GLD) March 21, 2025 - EXPIRATION AT MAX PROFIT

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (GLD) – EXPIRATION AT MAX PROFIT

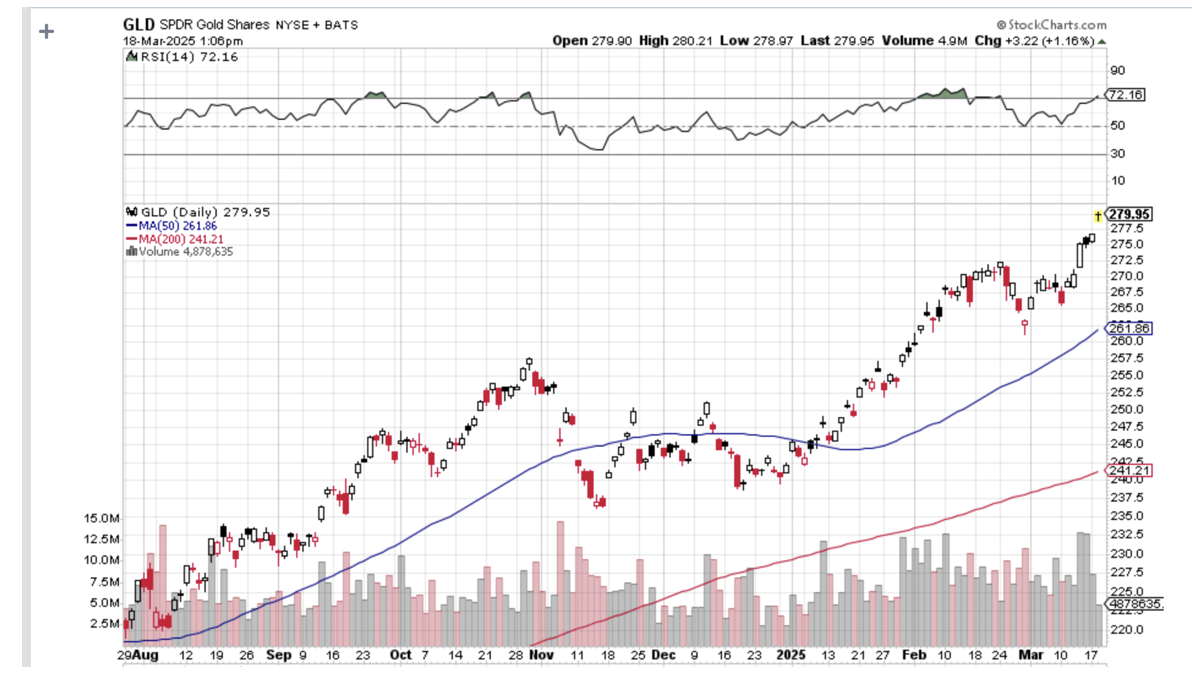

Expiration of the SPDR Gold Shares (GLD) March 2025 $240-$250 vertical BULL CALL debit spread at $10.00

Closing Trade

3-21-2025

expiration date: March 21, 2025

Portfolio weighting: 10%

Number of Contracts = 12 contracts

Because we have so many options positions expiring at max profit on the Friday, March 21 expiration day, I am going to start feeding these out now.

Like all successful trades, this one looks stupidly cautious with 20:20 hindsight and (GLD) at $279.95. All the sake stocks have been slaughtered. Bitcoin is down 30%, twice the (SPY) decline. The only flight to safety play left is gold, with silver catching up.

As a result, you get to take home $960 or 8.70% in 15 trading days. Well done and on to the next trade.

You don’t have to do anything with this expiration.

Your broker will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning March 24 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

The flight of money right now is from small, undercapitalized, and questionable to large, overcapitalized, and rock-solid balance sheets.

Gold has recently reaffirmed its status as a flight to safety asset class when safety is suddenly commanding a big premium. This is all happening against a backdrop of global wars, but also a rapidly deteriorating US Economy.

It is all very gold-positive.

If you can’t do options, buy the stock. My long-term target for (GLD) is $500, up nearly double from today’s $262.

The bull case for gold is simple. Falling interest rates mean less yield competition for gold, which yields nothing. China and Russia have been stockpiling gold for years to avoid international financial sanctions. The only way the Chinese can save right now is to buy gold.

A global gold shortage is developing with new mine costs rising. Gold also offers protection against rising US debt, which is expected to hit $35 trillion shortly.

On top of all this, Chinese speculators have shifted their principal savings vehicle from real estate, which has crashed and has no future, to gold. This adds a large retail element that has never existed before.

SPDR Gold Shares (GLD) is a play on physical gold. They are shares in a corporation that owns 400-ounce gold bullion bars held by a London trust. It is far safer owning gold through the (GLD) than owning your own physical gold bars via a third-party custodian. If the custodian goes under, which is frequent, your gold is gone. With (GLD) your credit risk is with State Street, a highly rated firm with a strong balance sheet.

For details about SPDR Gold Shares (GLD), please visit their website at https://www.spdrgoldshares.com.

This was a bet that the (GLD) would not fall below $250 by the March 21 option expiration in 15 trading days.

Here are the specific trades you need to exit this position:

Expiration of 12 March 2025 (GLD) $240 calls at…………$39.95

Expiration of short 12 March 2025 (GLD) $250 calls at…$29.95

Net Proceeds:………………………….………..………….…..........$10.00

Profit: $10.00 - $9.20 = $0.80

(12 X 100 X $0.80) = $960 or 8.70% in 15 trading days.