Trade Alert - (GLD) March 8, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

?

Trade Alert - (GLD)- TAKE PROFITS

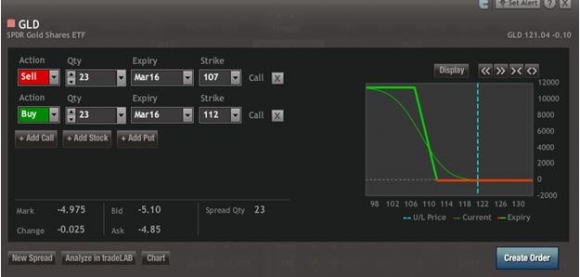

SELL the SPDR Gold Trust (GLD) March, 2016 $107-$112 in-the-money vertical bull call spread at $4.97 or best

Closing Trade ? NOT FOR NEW SUBSCRIBERS

3-8-2016

expiration date: March 18, 2016

Portfolio weighting: 10%

Number of Contracts = 23 contracts

Gold has had a pretty spectacular run here, leaping $220 in a straight line from $1,020.

As a result, our position in the SPDR Gold Trust (GLD) March, 2016 $107-$112 in-the-money vertical bull call spread is nearly at its maximum potential profit point.

Thanks to your faith in the barbarous relic, you have earned a 15.4% trading profit in just 12 trading days.

WELL DONE!

This is the second time in 2016 we have booked a profit in gold.

There is no point is hanging on for nine more trading days just to catch the last three cents in this spread.

Gold turned out to be the perfect asset to own in a negative interest rate (NIRP) world. Place money on deposit with a bank, and in two thirds of the world they will charge you money for the privilege.

Not so with gold.

Since I think that (NIRP) will be with us for the rest of the year, so will the bull market in gold. Therefore, I plan to jump back in on the first $50 pull back in the yellow metal.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 23 March, 2016 (GLD) $107 calls at????.?.??$14.00

Buy to cover short 23 March, 2016 (GLD) $112 calls at...$9.03

Net Cost:???????????????????.....$4.97

Profit: $4.97 - $4.30 = $0.67

(23 X 100 X $0.67) = $1,541 or 15.4% profit for the notional $100,000 portfolio.

Time to Take Some Chips off the Table

Time to Take Some Chips off the Table

?