Trade Alert - (GLD) November 6, 2024 - STOP LOSS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (GLD) – STOP LOSS

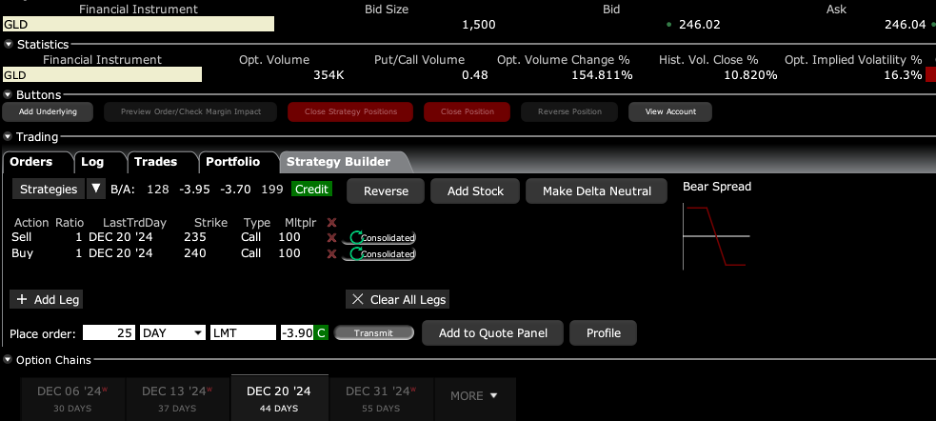

SELL the SPDR Gold Shares (GLD) December 2024 $235-$240 vertical BULL CALL debit spread at $3.90 or best

Closing Trade

11-6-2024

expiration date: December 20, 2024

Portfolio weighting: 10%

Number of Contracts = 25 contracts

When the fundamental argument for holding a position changes, you change the position.

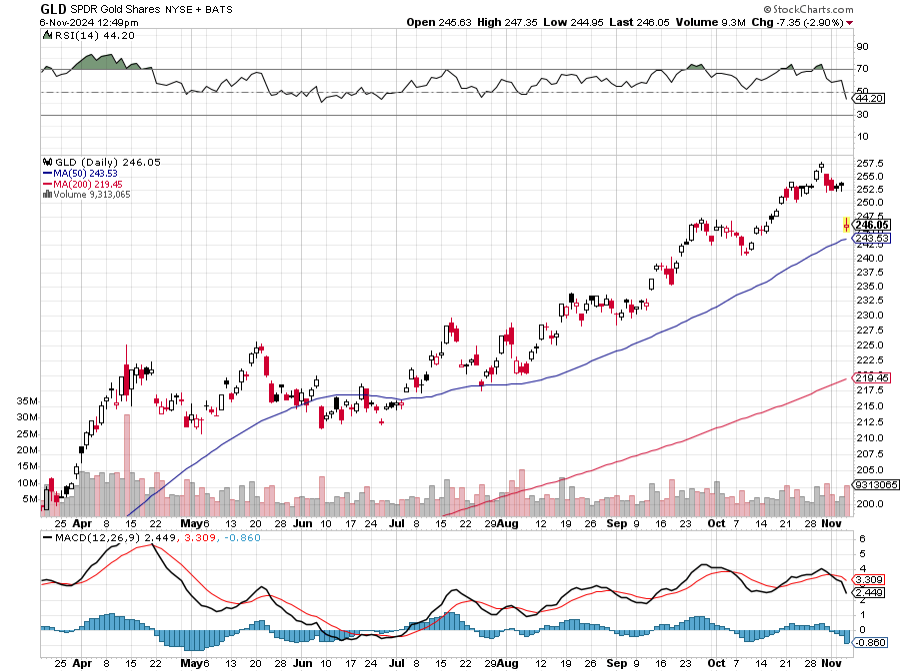

In view of the surprise Trump win in the US presidential election, it is clear that interest rates are now falling, but steeply rising. That means it’s time to bail on all falling interest rate plays, including gold.

I’ll go back into gold someday, as it is still being accumulated by central banks. But first I want to see where the new bottom is established.

Therefore, I am selling the SPDR Gold Shares (GLD) December $235-$240 vertical BULL CALL debit spread at $3.90 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to spend all day in front of a screen, simply enter a spread of Good-Until-Cancelled orders overnight, like $3.90, $3.85, $3.80, $3.75, and $3.70. You should get done on some or all of these.

SPDR Gold Shares (GLD) is a play on physical gold. They are shares in a corporation that owns 400-ounce gold bullion bars held by a London trust. It is far safer owning gold through the (GLD) than through owning your own physical gold bars via a third-party custodian. If the custodian goes under, which is frequent, your gold is gone. With (GLD) your credit risk is with State Street, a highly-rated firm with a strong balance sheet.

For details about SPDR Gold Shares (GLD) please visit their website at https://www.spdrgoldshares.com.

This was a bet that the (GLD) will not fall below $240 by the December 20 option expiration in 22 trading days.

Here are the specific trades you need to exit this position:

Sell 25 December 2024 (GLD) $235 calls at…………......………$14.00

Buy to cover short 25 December 2024 (GLD) $240 calls at…$10.10

Net Proceeds.……....................…………….………..………….….....$3.90

Loss: $4.20 - $3.90 = -$0.30

(25 X 100 X -$0.30) = $750.

If you are uncertain about how to execute a bear put options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.