Trade Alert - (GM) March 24, 2025 - STOP LOSS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (GM) - STOP LOSS

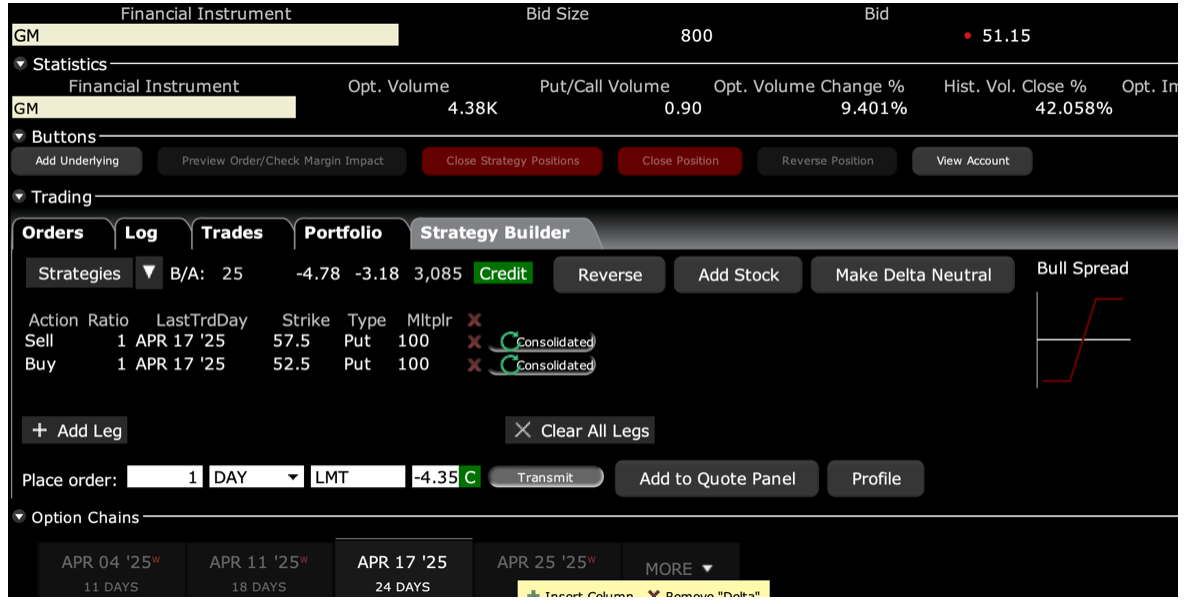

Sell the General Motors (GM) April 2025 $52.50-$57.50 in-the-money vertical bear put debit spread at $4.35 or best

Closing Trade

3-24-2025

expiration date: April 17, 2025

Portfolio weighting: 10% weighting

Number of Contracts = 25 contracts

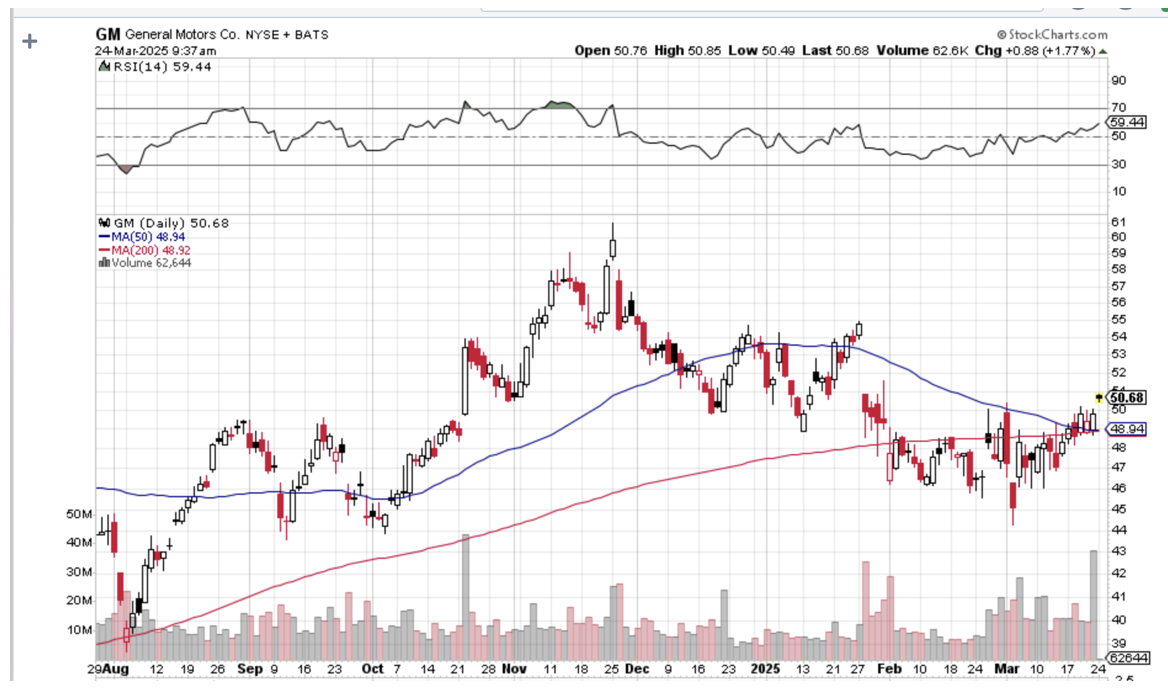

I don’t like the way this short position is behaving.

We heard news today that the proposed tariffs may get diluted. As a result, we are approaching our near-strike price. The key to this market is not how much money you make, but avoiding losses.

It clearly has lost its downside momentum. What’s more, the president has figured out that he can scare the shorts by making vaguely positive comments about the trade war.

(GM) is the one stock most likely to pop on any surprise trade war resolution or any hints thereof and we are only $3.00 or 6% from the nearest strike price with 19 trading days to run.

In other words, the risk/reward is now less appealing than when I put this on 6 trading days ago. I am able to get out at cost because even though the stock has gone $2.36 against us while rising, the implied volatility has collapsed from 44% to 27%. Such is the wonder of a vertical bear put debit spreads.

Therefore, I am selling the General Motors (GM) April 2025 $52.50-$57.50 in-the-money vertical bear put debit spread at $4.35 or best.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Don't pay more than $4.60 or you will be chasing.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 5 cents with a second order.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $4.35, $4.30, $4.25, and $4.20. You should get done on some or all of these.

With this trade, I was willing to bet that (GM) shares would not rise above $52.50 by the April 17 option expiration in 25 trading days.

Here are the specific trades you need to exit this position:

Sell 25 April 2025 (GM) $57.50 puts at………..................…$7.00

Buy to cover short 25 April 2025 (GM) $52.50 puts at…….$2.65

Net Proceeds:………………………….……….………..............……$4.35

Loss: $4.35 - $4.35 = $0.00

(25 X 100 X $0.00) = $0.00

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.