Trade Alert - (HD) March 13, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (HD) – BUY

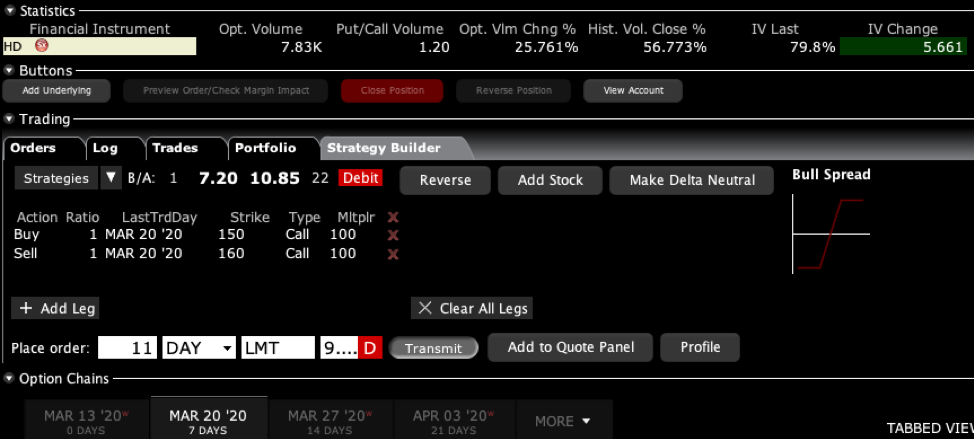

BUY the Home Depot (HD) March 2020 $150-$160 in-the-money vertical Bull Call spread at $8.70 or best

Opening Trade

3-13-2020

expiration date: March 20, 2020

Portfolio weighting: 10%

Number of Contracts = 11 contracts

The market has just given up 9,000 points and Home Depot $60, or 25%. So, I am going to dip my toe in the water here with a very deep in-the-money Home Depot long.

With the Volatility Index (VIX) at a sky-high $75, the risk/reward of going back into a call spread is astronomical. I believe that Home Depot shares will reach $245 again sometime in 2021.

In other words, you don’t get a better long side entry point than this.

Not only that, with the Mad Hedge Market Timing Index at 3 level, down from 95, its 2020 low, we are at the bottom end of a 30-year range.

I am therefore buying the Home Depot (HD) March 2020 $150-$160 in-the-money vertical Bull Call spread at $8.70 or best.

To lose money on this trade, Home Depot would have to drop another 18%, or $35 to the December 2018 lows by Friday. That is a 35% top to bottom crash.

This is a bet that Home Depot (HD) will not trade below $160 by the March 20 option expiration day in 5 trading days.

Don’t pay more than $9.50 for this position or you’ll be chasing.

If you don’t do options stand aside. If you already own Home Depot shares, which you almost certainly do if you read this newsletter, just keep them.

Here are the specific trades you need to execute this position:

Buy 11 March 2020 (HD) $150 calls at………….…….…$47.00

Sell short 11 March 2020 (HD) $160 calls at…….…….$38.30

Net Cost:……………………..…….………..………….…..........$8.70

Potential Profit: $10.00 - $8.70 = $1.30

(11 X 100 X $1.30) = $1,430 or 14.94 in 5 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.