Trade Alert - (IBKR) March 15, 2023 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert – (IBKR) – BUY

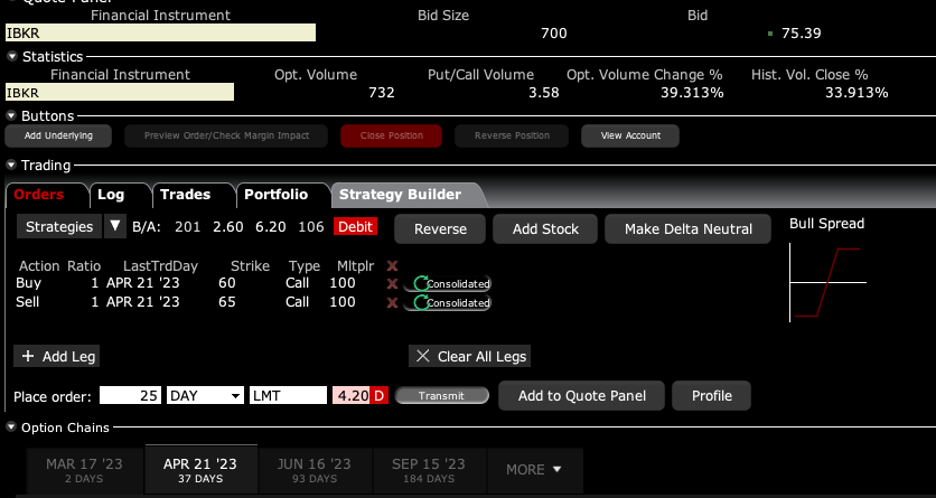

BUY the Interactive Brokers (IBKR) April 2023 $60-$65 in-the-money vertical Bull Call debit spread at $4.20 or best

Opening Trade

3-15-2023

expiration date: April 21, 2023

Number of Contracts = 25 contracts

News that Credit Suisse in Switzerland is in trouble has sparked round two of the regional bank crises. Don’t touch (CS), which will no doubt get taken over by the Swiss National Bank. I will continue to bottom fish among strong financial institutions which I know personally and have no connection with the current crisis.

I hate to make money at someone else’s expense. Buy hey, a buck is a buck. In karate school in Japan, they always teach you to kick a man when he is down because that is when they are least likely to hit you back.

It is in that mean spirit that I am taking advantage of the Silicon Valley Bank crisis to dive in on Interactive Brokers (IBKR), which has cratered 18% in a week. (IBKR) has a rock-solid balance sheet, is heavily regulated, and is expert at risk control, often at your expense.

It helps also that the Volatility Index ($VIX) has just rocketed bank up to $28 and a Mad Hedge Market Timing Index that just plunged to only 18.

I am therefore buying the Interactive Brokers (IBKR) April 2023 $60-$65 in-the-money vertical Bull Call debit spread at $4.20 or best.

The volatility is so extreme this morning that I am having to guess on this price. Just do the best you can. Many stocks have halted trading.

Don’t pay more than $4.60 or you’ll be chasing on a risk/reward basis.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

To learn more about the company please visit their website at https://www.interactivebrokers.com/

This is a bet that Interactive Brokers will not fall below $65 by the April 21 options expiration in 22 days.

Here are the specific trades you need to execute this position:

Buy 25 April 2023 (IBKR) $60 calls at………….………$17.00

Sell short 25 April 2023 (IBKR) $65 calls at…….……$12.80

Net Cost:………………………….…….…..................…......$4.20

Potential Profit: $5.00 - $4.20 = $0.80

(25 X 100 X $0.80) = $2,000 or 19.05% in 22 days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.