Trade Alert - (IWM) August 2, 2024 - STOP LOSS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (IWM) – STOP LOSS

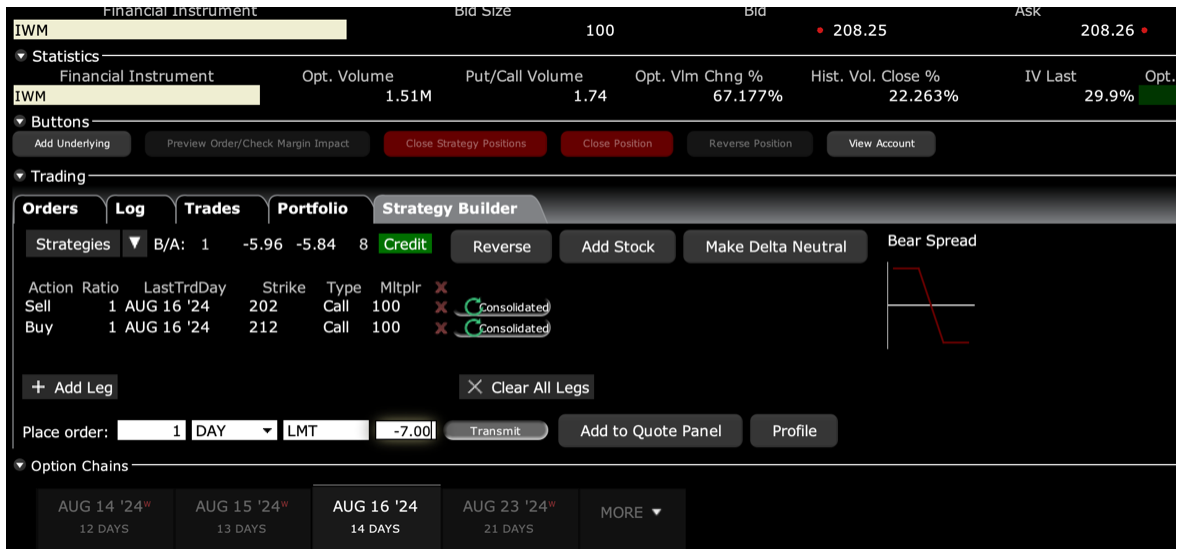

SELL the iShares Russell 2000 ETF (IWM) August 2024 $202-$212 in-the-money vertical Bull Call spread at $7.00 or best

Closing Trade

8-2-2024

expiration date: August 16, 2024

Portfolio weighting: 10%

Number of Contracts = 12 contracts

The disastrous July Nonfarm Payroll Report was out this morning at 114,000, and a Headline Unemployment Rate was popping to a one-year high at 4.3%. It was the first real black swan in a year.

It showed traders that a recession is now a sure thing if the Fed doesn’t take immediate action to cut interest rates, which they might. To a trader, “might” means “SELL”.

It triggered panic dumping across the board, especially in Big Tech stocks where we only have short positions. We also saw the largest one-day drop in the Mad Hedge Market Timing Index, from 46 to 26. In the meantime, our interest rate plays are rocketing, with the (TLT) hitting an incredible $98.

Small Caps also don’t do well in recessions since they lack the cash reserves in recession. Since we have dramatically crossed our upper strike price of $112, I am forced to sell my position in (IBKR).

I don’t think we are going into a recession. What this Nonfarm Payroll Report WILL do is forcer the Fed to cut interest rates faster, sooner. But it will take the markets a couple of weeks to figure that out. In the meantime, STOP LOSS is the order of the day.

Keep in mind that 60% of the remaining small caps are regional US banks. Lower interest rates will make their troubles in the local commercial real estate market go ahead. They will also assist with the recapitalization of these small institutions which they all sorely need.

I am therefore buying the iShares Russell 2000 ETF (IWM) August 2024 $202-$212 in-the-money vertical Bull Call spread at $7.00 or best.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 10 cents with a second order.

This was a bet that the iShares Russell 2000 ETF would not fall below $212 by the August 16 option expiration in 11 trading days.

Here are the specific trades you need to close out this position:

Sell 12 August 2024 (IWM) $202 calls at………….……............…$9.00

Buy to cover short 12 August 2024 (IWM) $212 calls at…………$2.00

Net Proceeds:………………………….………..………….…..................$7.00

Loss: $9.00 - $7.00 = -$2.00

(12 X 100 X -$2.00) = -$2,400

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.