Trade Alert - (IWM) November 22, 2017 STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (IWM) SELL-STOP LOSS

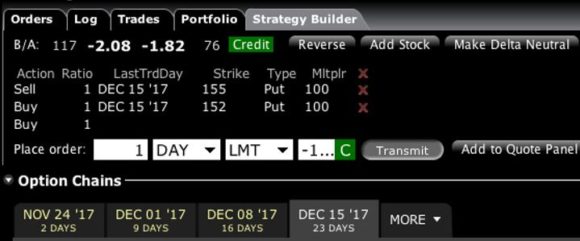

SELL the IShares Russell 2000 ETF (IWM) December, 2017 $152-$155 in-the-money vertical BEAR PUT spread at $2.08 or best

Closing Trade

11-22-2017

expiration date: December 15, 2017

Portfolio weighting: 10%

Number of Contracts = 40 contracts

This trade is proof that I'm not always right.

I need to take a hit like this every few months to remind me that only humble traders make it over the long term.

This trade also shows why you don't let positions grow hair on them.

In five trading days, this position turned from a 16% winner to a 17% loser.

Still, when people buy fire insurance and their homes don't burn down, they usually don't complain.

The loss on this position is more than offset by profits I have in my shorts in US Treasury bonds (TLT), the Euro (FXE), and a long in gold (GLD).

However, this is my second month in a row when my hedge ate up most of my performance. It turned a blockbuster month into a mediocre one, but still positive.

It is a screaming testimony to the kind of crazy markets we are in.

What I missed with this trade was how fast the Republicans would move the tax bill through congress.

With no public hearings, apparently the plan is to push through the largest redistribution of wealth in US history before anyone has time to read it and mobilize opposition.

Lower taxes are hugely positive for small cap stocks and the (IWM).

I still think the bill will fail in the Senate on the first go around, or not even be put up for a vote.

But then we are doomed to trade the market we have, not the one we want.

Risk control is paramount right now, and I have monster profits to protect.

I am therefore going to stop out of my position in the IShares Russell 2000 ETF (IWM) December, 2017 $152-$155 in-the-money vertical BEAR PUT spread

This was a bet that the Russell 2000 which trade at or below $152 by theDecember 15 option expiration in 26 trading days.

We still have 15 days left, and I am getting no joy.

Here are the specific trades you need to execute this position:

Sell 40 December, 2017 (IWM) $155 puts at.........................................$4.40

Buy to cover short 40 December, 2017 (IWM) $152 puts at..........................$2.32

Net Proceeds:........................................................................................

Loss: $2.50 - $2.08 = $0.42

(40 X 100 X $0.42) = -$1,680

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.