Trade Alert - (JPM) January 29, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (JPM) – BUY

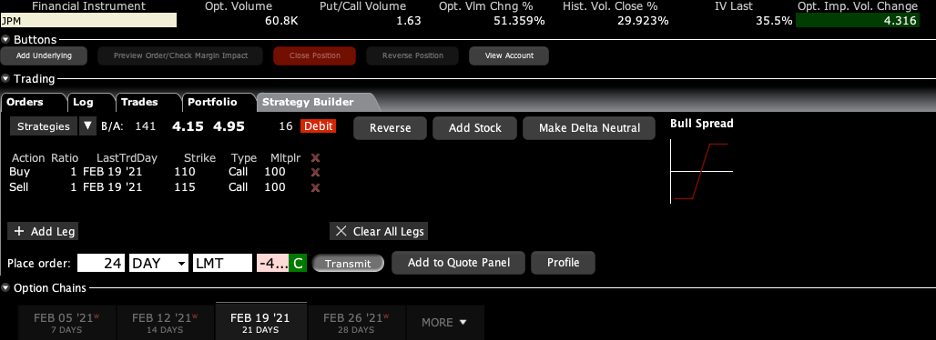

BUY the JP Morgan (JPM) February 2021 $110-$115 in-the-money vertical Bull Call spread at $4.30 or best

Opening Trade

1-29-2021

expiration date: February 19, 2021

Portfolio weighting: 10%

Number of Contracts = 24 contracts

If you don’t do options, buy the stock. My target for (JPM) this year is $200, up 60%.

I told you I’d be back in this name, I just didn’t think it would be in 3 ½ hours.

The stampede into stocks with huge short interests like GameStop (GME) is forcing hedge funds to jump their good stocks (JPM) to cover their enormous losses in their shorts.

This has created systemic fears for the stock market as a whole, which are wildly overblown.

This has pushed the Volatility Index (VIX) up to a sky-high $38, which has the effect of vastly overvaluing stock options. This is a gift for traders like us.

In addition, my own Mad Hedge Market Timing Index is strongly in “BUY” territory at 35. This is the lowest level since before the presidential election three months ago.

I am therefore buying the JP Morgan (JPM) February 2021 $110-$115 in-the-money vertical Bull Call spread at $4.30 or best.

Don’t pay more than $4.60 or you’ll be chasing.

JP Morgan Chase (JPM) announced blockbuster earnings last week and the shares sold off big. It was a classic “Buy the rumor, sell the news” type move.

That has given us a gift. (JPM) is the class act in the global banking sector, and CEO Jamie Diamond is the best CEO in the country.

I believe that massive government borrowing and spending will drive US interest rates up through the roof and the value of the US dollar (UUP) down. Banks love high interest rates because they vastly improve profit margins.

Covid-19 is rapidly approaching its third peak. Total US deaths could exceed the 1919 Spanish Flu 625,000 peak by the time it is all over. We passed all WWII deaths last week.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

This is a bet that JP Morgan (JPM) will not fall below $115 by the February 19 option expiration day in 14 trading days.

Here are the specific trades you need to execute this position:

Buy 24 February 2021 (JPM) $110 calls at………….………$19.00

Sell short 24 February 2021 (JPM) $115 calls at………....$14.70

Net Cost:……………………..…….………..…………...........….....$4.30

Potential Profit: $5.00 - $4.30 = $0.70

(24 X 100 X $0.70) = $1,680 or 16.27% in 14 trading days.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.