Trade Alert - (JPM) November 7, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (JPM) – BUY

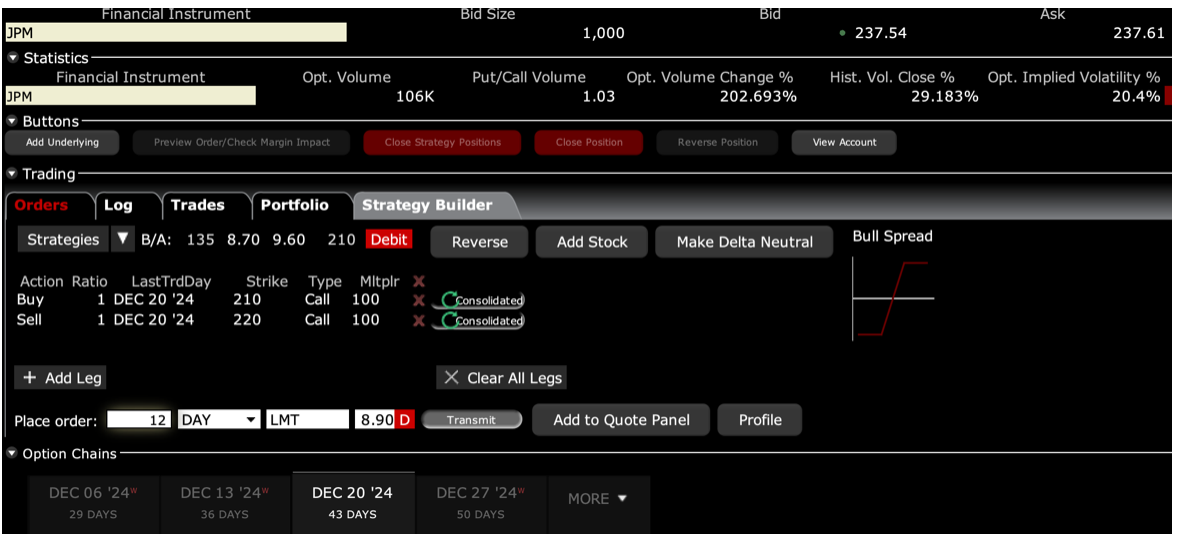

BUY the JP Morgan Chase (JPM) December 2024 $210-$220 in-the-money vertical Bull Call debit spread at $8.90 or best

Opening Trade

11-7-2024

expiration date: December 20, 2024

Number of Contracts = 12 contracts

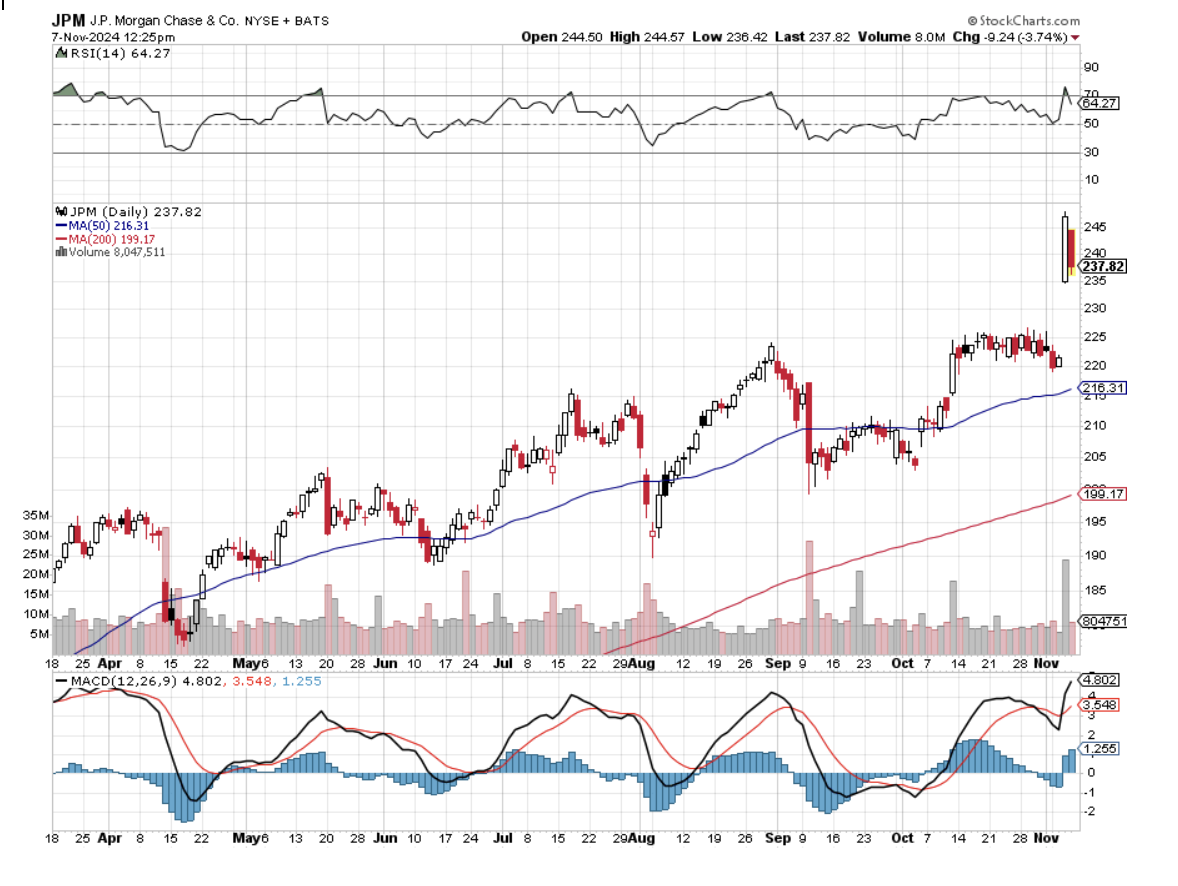

There has just been an $8 pullback in (JPM) shares, America’s premier commercial bank.

There is a new theme in the post-election market. Falling interest rates are out, deregulation is in.

There is no more regulated industry than financials, as many of you in the industry already know. Any lightening of the burden flows straight to the bottom line. It also opens up new business for (JPM) in that antitrust is out the window. That will lead to a big increase in mergers & acquisitions business, where (JPM) is very active.

I am therefore buying the JP Morgan Chase (JPM) December 2024 $210-$220 in-the-money vertical Bull Call debit spread at $8.90 or best.

Don’t pay more than $9.40, or you’ll be chasing on a risk/reward basis.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

If you live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $8.90, $9.00, $9.10, and $9.20. You should get done on some or all of these.

To learn more about the company, please visit their website at

https://www.jpmorganchase.com

This is a bet that JP Morgan Chase (JPM) will not fall below $220 by the December 20 option expiration in 30 trading days.

Here are the specific trades you need to execute this position:

Buy 12 December 2024 (JPM) $210 calls at………….………$30.00

Sell short 12 December 2024 (JPM) $220 calls at…………$21.10

Net Cost:………………………….………..…..............................$8.90

Potential Profit: $10.00 - $8.90 = $1.10

(12 X 100 X $1.10) = $1,320 or 12.36% in 30 days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.