Trade Alert - (JPM) October 6, 2022 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (JPM) – BUY

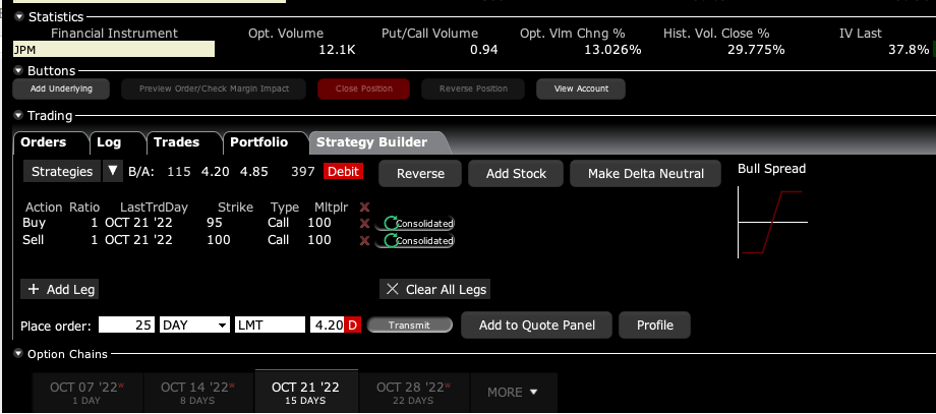

BUY the JP Morgan (JPM) October 2022 $95-$100 in-the-money vertical Bull Call spread at $4.20 or best

Opening Trade

10-6-2022

expiration date: October 21, 2022

Number of Contracts = 25 contracts

The banking sector has been beaten like the proverbial red-headed stepchild this year. However, it should be at the core of any long-term LEAPS portfolio.

The best time to pick up this position will be during a market meltdown day when the (SPX) is trading under $3,500 and the Volatility Index is over $34.

(JPM) is the class act in the global banking sector, and CEO Jamie Diamond is the best CEO in the country. Not only that, with rocketing interest rates, we are just entering the golden age of the banking sector.

I believe that massive government borrowing and spending will drive US interest rates up through the roof. Banks love high interest rates because they vastly improve profit margins.

And here is the sweet spot. Fears of a recession increasing loan default rates have knocked $66, or 39% off the $170 high in (JPM) shares this year. We are now only $20 above the 2020 pandemic low. When recession fears fade in 2023, interest rates will still remain historically high and (JPM) profits and share price should rocket.

To learn more about the company, please visit their website at https://www.jpmorganchase.com.

I am therefore buying the JP Morgan (JPM) October 2022 $95-$100 in-the-money vertical Bull Call spread at $4.20 or best.

Don’t pay more than $4.50 or you’ll be chasing on a risk/reward basis.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that JP Morgan will not fall below $100 by the October 21, 2022 options expiration in 11 trading days.

Here are the specific trades you need to execute this position:

Buy 25 October 2022 (JPM) $95 calls at…………..………$15.00

Sell short 25 October 2022 (JPM) $100 calls at…………$10.80

Net Cost:…………..........……………….………..………….….....$4.20

Potential Profit: $5.00 - $4.20 = $0.80

(25 X 100 X $0.80) = $2,000 or 20% in 11 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.