Trade Alert - (META) August 5, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (META) – BUY

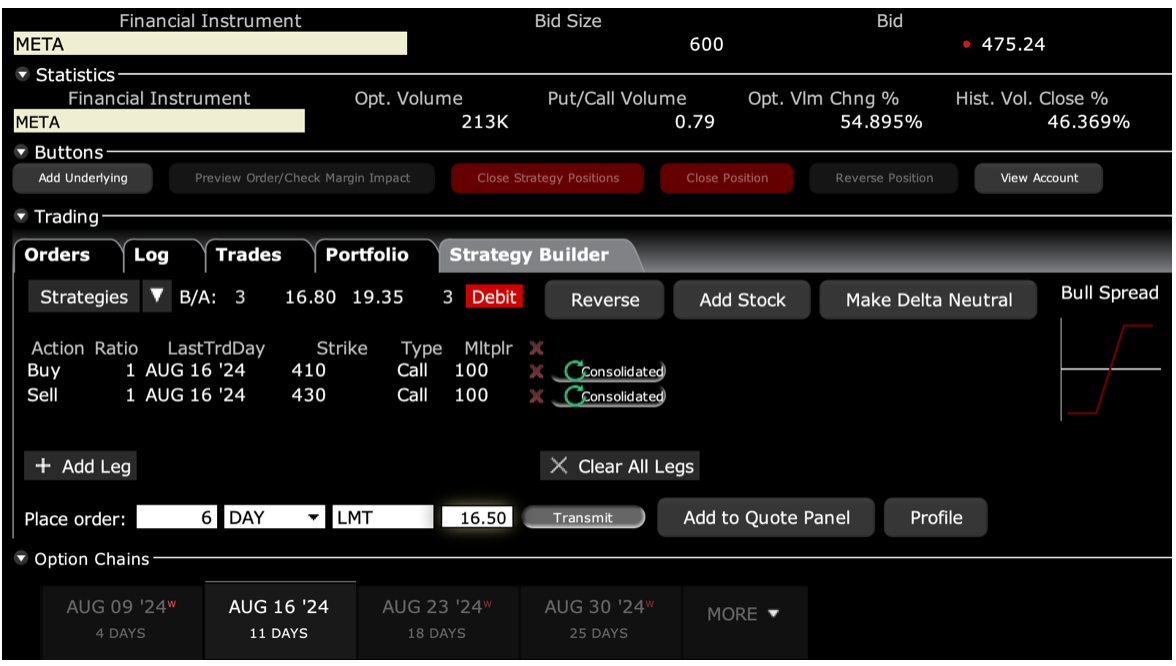

BUY the (META) August 2024 $410-$430 vertical BULL CALL spread at $16.50 or best

Opening Trade

8-5-2024

expiration date: August 16, 2024

Portfolio weighting: 10%

Number of Contracts = 6 contracts

The Volatility Index ($VIX) has just backed off from a historic high of $68 to $30, but is still expensive against last week’s low of $12.

That means it's still not too late to add deep in-the-money call spreads on the highest quality technology stocks. In Addition, Meta is $90 or 20% off its recent high. Its recent earnings report was spectacular, with a surge in new advertising income.

This trade also gets the benefit of support for the 200-day moving average at $433.77. It is extremely rare to trade with a Volatility Index ($VIX) of $30 and a Mad Hedge AI Market Timing Index of 19. I can really only count the occasions on one hand.

If the trading history of this year provides any lessons, it is that one-day meltdowns of the highest quality stocks are huge “BUYS”. Mark Zuckerberg’s request that shareholders show “patience” in the rollout of its AI strategy is absolutely what they did not want to hear. The word is poison to traders and delivered us an immediate 14% selloff in the stock. Everyone wants BIG PROFITS RIGHT NOW.

As a result, we get a great entry point in one of the front runners of the AI revolution. (META) is (NVIDIA)’s largest customer for high-end graphics chips, which says a lot.

Therefore, I am buying the (META) August 2024 $410-$430 vertical BULL CALL spread at $16.50 or best.

Don’t pay for than $18.00 or you will be chasing.

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done cancel your order and increase your bid by 10 cents with a second order.

Meta, originally founded by Mark Zuckerberg as Facebook in 2004, is the world’s preeminent social media company. It owns and operates Facebook, Instagram, Threads, among other products and services. Meta ranks among the largest American information technology companies. If you haven’t heard of Meta, you’ve been living in a cave for the last 20 years.

This is a bet that the (META) will not fall below $330.00 by the August 16 option expiration in 9 trading days. It is also a bet that (META) does not break below the 200-day moving average at $372, some $60, or 13.67% lower, where it has huge support.

Here are the specific trades you need to execute this position:

Buy 6 August 2024 (META) $410 calls at………….………$71.00

Sell short 6 August 2024 (META) $430 calls at…………$54.50

Net Cost:………………………….………..………….…..............$16.50

Potential Profit: $20.00 - $16.50 = $3.50

(6 X 100 X $3.50) = $2,100 or 21.21% in 9 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.