Trade Alert - (MSFT) January 30, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

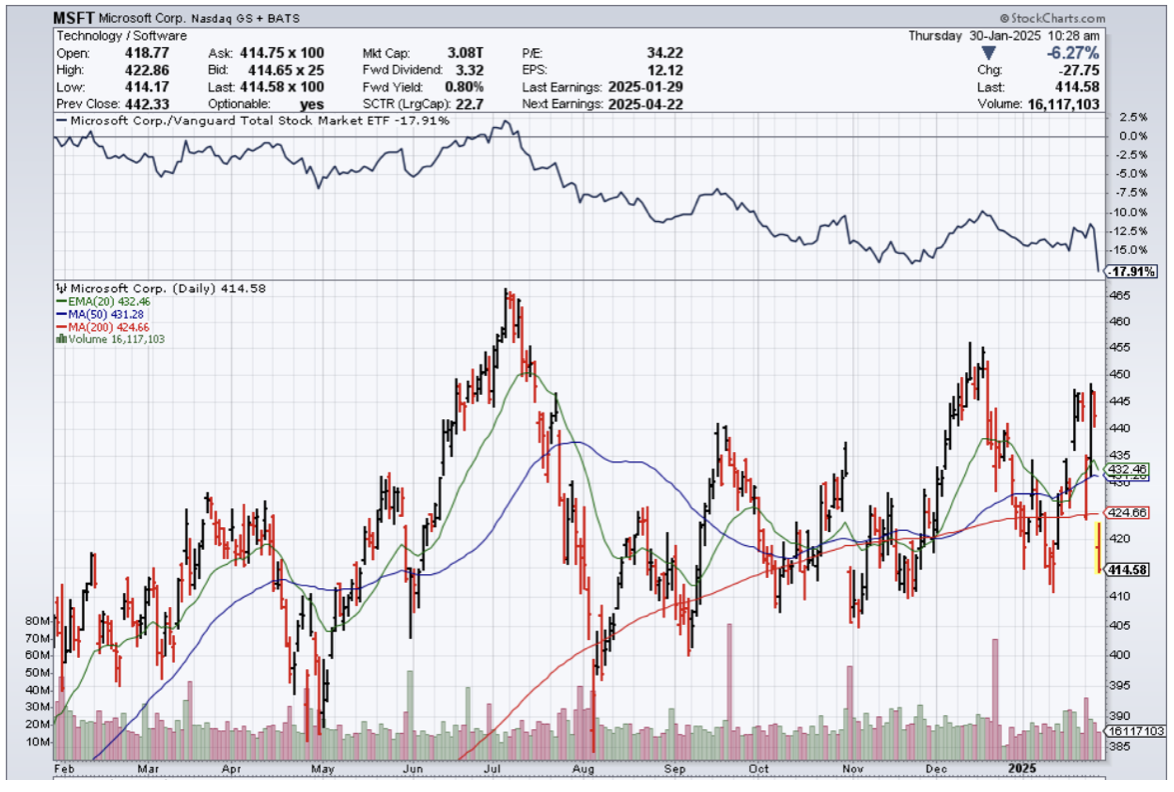

Tech Alert - Microsoft Corporation (MSFT) – BUY

Buy Microsoft Corporation (MSFT) February 2025 $390-$395 in-the-money vertical BULL CALL spread at $4.00

Opening Trade

1-30-2025

expiration date: February 21, 2025

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Microsoft Corporation (MSFT) dropped on a poor cloud forecast and the stock is shockingly down OVER 6.5% today.

I am executing a bullish short-term call spread in MSFT.

More aggressive traders can move up the upper strike price to $400 or $405.

Don’t pay more than $4.15.

Here are the specific trades you need to execute this position:

Buy to Open 25 February 2025 (MSFT) $390 calls at………….$27.20

Sell to short 25 February 2025 (MSFT) $395 calls at………….$23.20

Net Cost:……………………..…….………..……................................$4.00

Potential Profit: $5 - $4 = $1

(25 X 100 X $1) = $2,500 or 25% in 22 days

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.