Trade Alert - (MSFT) March 11, 2020 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (MSFT) - BUY

BUY the Microsoft (MSFT) March 2020 $120-$125 in-the-money vertical BULL CALL spread at $4.40 or best

Opening Trade

3-11-2019

expiration date: March 20, 2020

Portfolio weighting: 10%

Number of Contracts = 23 contracts

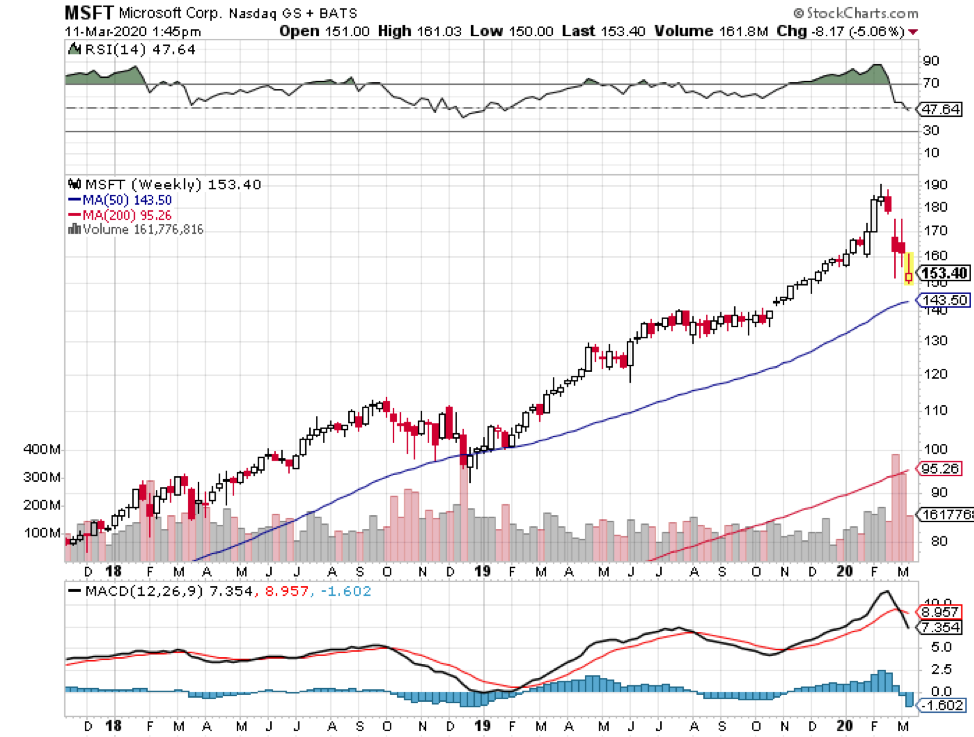

I am going to use today’s Corona induced 1250-point dip in the Dow Average to step back into Microsoft one more time. It’s gotten to the point where if a portfolio manager DOESN’T own Microsoft, he risks getting fired. This is from a trader who has been buying the stock since it was $50.

You don’t get any better quality than Microsoft (MSFT) in the tech world. It is the safest stock in which to invest today. This is a stock that you want to hide behind the radiator and keep forever. It is also one of the great turnaround stories of the decade.

In addition, this particular combination of strike prices gives you huge support at these prices since they are discounting a full-on recession. Please note, this option spread will be profitable whether the market goes up, sideways, or down small over the next seven days.

I am therefore buying the Microsoft (MSFT) March 2020 $120-$125 in-the-money vertical BULL CALL spread at $4.40 or best.

If you get the March 2020 $120-$125 in-the-money vertical BULL CALL spread, try the $125-$130 or the $130-$135. These are all very low-risk strike prices.

Don’t pay more than $4.70 or you’ll be chasing.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

If you don’t do options, buy the stock outright lower down for a long-term play.

This is a bet that Microsoft shares will NOT fall below $125.00 by the March 20 option expiration date in 7 trading days.

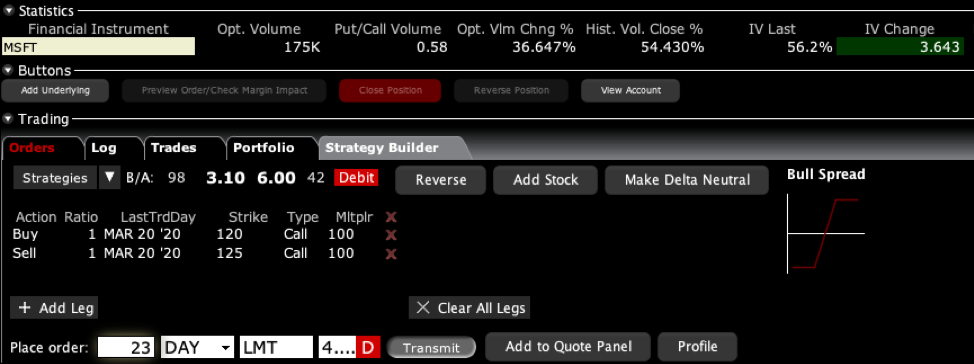

Here are the specific trades you need to execute this position:

Buy 23 March 2020 (MSFT) $120 calls at……..…...…$36.00

Sell short 23 March 2020 (MSFT) $125 calls at……..$31.60

Net Cost:………………………….…………........…..….…......$4.40

Potential Profit: $5.00 - $4.40 = $0.60

(23 X 100 X $0.60) = $1,100 or 11.11% in 7 trading days.

The optics today look utterly different from when Bill Gates was roaming around the corridors in the Redmond, Washington headquarter and that is a good thing in 2018.

Current CEO Satya Nadella has turned this former legacy company into the 2nd largest cloud competitor to Amazon and then some.

Microsoft Azure is rapidly catching up to Amazon in the cloud space because of the Amazon-effect working in reverse. Companies don’t want to store proprietary data to Amazon’s server farm when they could possibly destroy them down the road. Microsoft is mainly a software company and gained the trust of many big companies especially retailers.

Microsoft is also on the vanguard of the gaming industry taking advantage of the young generation’s fear of outside activity. Xbox-related revenue is up 36% YOY, and its gaming division is a $10.3 billion per year business. Microsoft Azure grew 87% YOY last quarter.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.