Trade Alert - (ORCL) January 2, 2020 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - (ORCL) – SELL – TAKE PROFITS

SELL Oracle Corporation (ORCL) January 2020 $50.00-$52.5 in-the-money vertical BULL CALL spread at $2.31

Closing Trade

1-2-2020

expiration date: January 17, 2020

Portfolio weighting: 10%

Number of Contracts = 45 contracts

This was a bet that Oracle Corporation would not drop more 2.8% by January 17.

Oracle did exactly what I thought it would do on the earnings call by not being able to meet expectations due to a shortfall in license revenue brought on by continued effects of a sales reorganziation earlier this year.

They are only estimated to grow sales 2.9% next year and that is what you basically get from Oracle.

Shares crashed offering us an entry point.

Unfortunately, this trade went against us from the moment we executed it and the pop in shares of over 1% today gives us a chance to get out with a small profit.

There’s a high chance that traders will get an even better entry point into Oracle and I rather cash in this single than wait for a home run.

The company doesn’t grow top-line and is a legacy database software company headed by old hand Larry Ellison.

Even with the legacy status firmly tattooed on their foreheads, Oracle is a massive revenue scooper and that is in vogue right now.

They profited $11 billion on $39.5 billion of revenue in the past year and possess the type of balance sheet that is extra valuable right now in the eyes of traders.

They don’t risk losing their operational license like Uber in London and their CEO doesn’t take off for Africa for 6 months like Twitter’s Jack Dorsey.

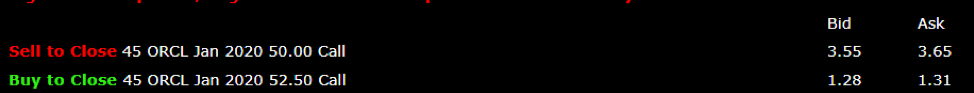

Here are the specific trades you need to execute this position:

Sell 45 January 2020 (ORCL) $50 call at………….…..........……$3.60

Buy to cover short 45 January 2020 (ORCL) $52.50 call at….$1.29

Net Proceeds:……...................………………..…….………..…….....$2.31

Profit: $2.31- $2.22= $0.09

(45 X 100 X $0.09) = $405 or .405%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.