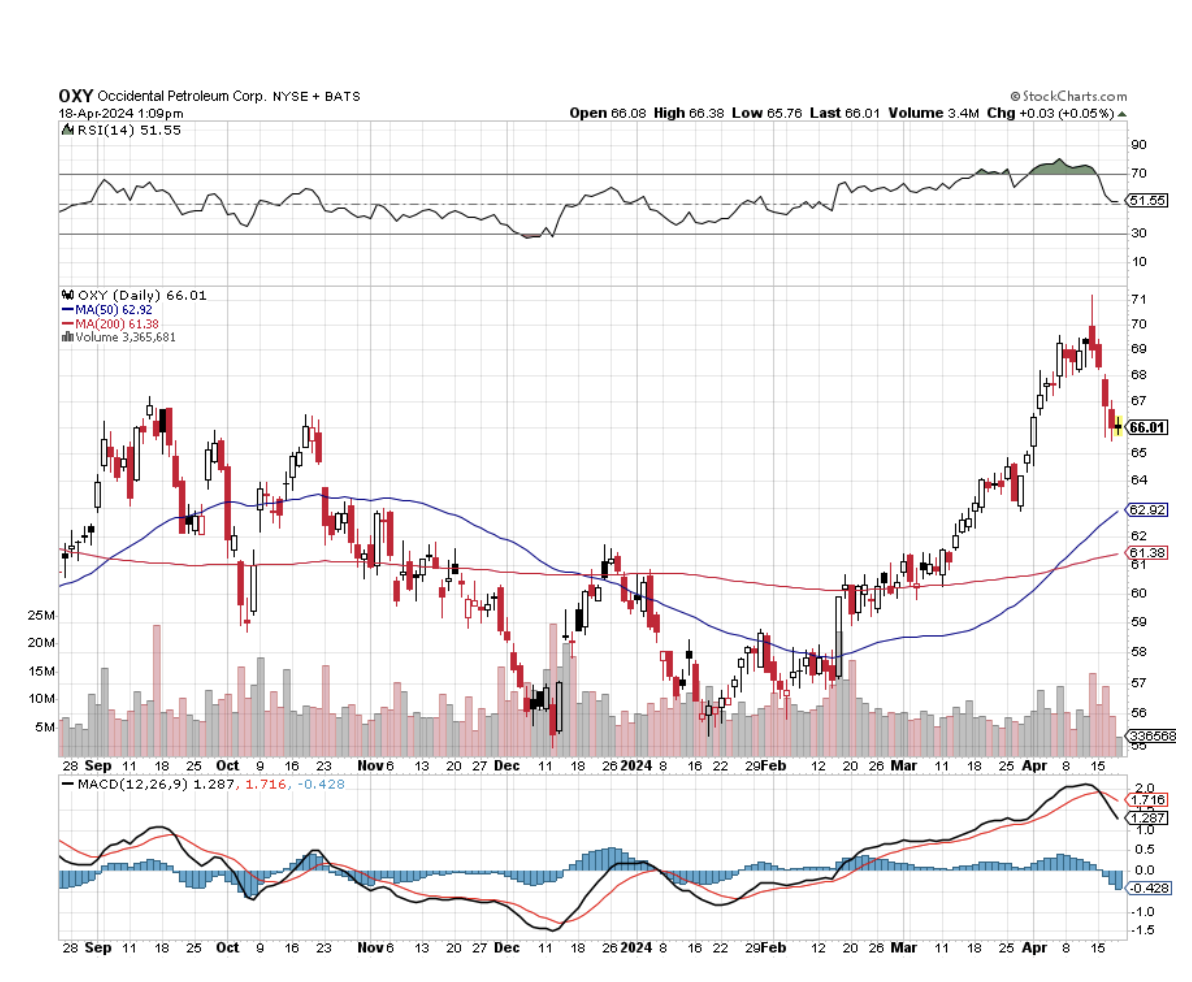

Trade Alert - (OXY) April 19, 2024 - EXPIRATION AT MAX PROFIT

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (OXY) - EXPIRATION

EXPIRATION of the Occidental Petroleum (OXY) April 2024 $59-$62 in-the-money vertical bull call spread at $3.00

Closing Trade

4-19-2024

expiration date: April 19, 2024

Portfolio weighting: 10%

Number of Contracts = 40 contracts

With this trade, we really nailed the explosion in (OXY) shares this month. This position is expiring an earth-shaking 20.24% in the money.

Just to be clear, this position does not expire until after the close today.

As a result, you get to take home $1,600, or 15.38% in 15 trading days. Well done and on to the next trade.

You don’t have to do anything with this expiration.

Your broker will automatically use your long position to cover your short position, canceling out the total holdings.

The entire profit will be credited to your account on Monday morning, April 22 and the margin freed up.

Some firms charge you a modest $10 or $15 fee for performing this service.

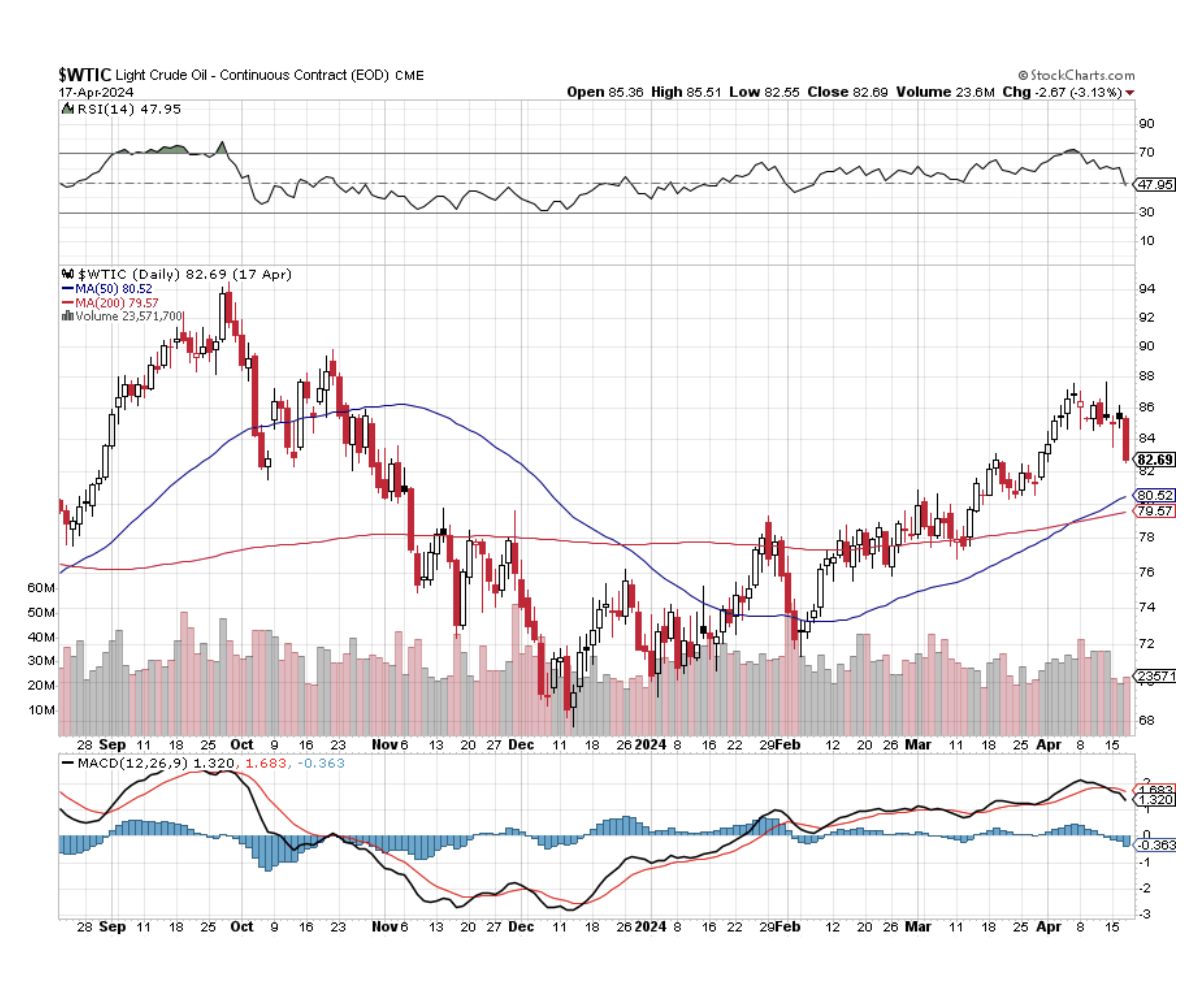

The flight of money right now is from small, undercapitalized, and questionable to large, overcapitalized, and rock solid.

To learn more about Occidental Petroleum, please visit their website at https://www.oxy.com.

This was a bet that the Occidental Petroleum (OXY) would not trade below $62 by the April 19 option expiration day in 15 trading days.

Here are the specific trades you need to close out this position:

EXPIRATION of 40 April 2024 (OXY) $59 calls at…….....….…$7.01

EXPIRATION off short 40 April 2024 (OXY) $62 calls at…….$4.01

Net Proceeds:………………………….……….…………..................…$3.00

Profit: $3.00 - $2.60 = $0.40

(40 X 100 X $0.40) = $1,600, or 15.38% in 15 trading days.