Trade Alert - (PANW) August 23, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Trade Alert - (PANW) - BUY

BUY the Palo Alto Networks, Inc. (PANW) September 2019 $170-$175 in-the-money vertical BULL CALL spread at $3.83 up to $4.15

Opening Trade

8-23-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 26 contracts

Palo Alto Networks, Inc. provides security platform solutions worldwide. The company provides firewall appliances and software; Panorama, a security management solution for the control of appliances deployed on an end-customer's network as a virtual or a physical appliance

Implied volatility has shot out the roof giving us an entry point.

Initially, I missed an entry point when (PANW) dipped amid a report that another top executive is leaving the cybersecurity firm. Palo Alto stock slipped after The Information reported that David Peranich, executive vice president of worldwide sales, is exiting the company.

Peranich has been with Palo Alto for three years. Palo Alto stock fell 7.2% to close at 199.25 that day and has since recovered a little.

Chief Executive Nikesh Arora, a former top executive at Alphabet unit Google (GOOGL), took the cybersecurity firm's helm in June 2018. Several management changes followed last year. Chief Marketing Officer Rene Bonvanie left in July to manage a chronic illness, the company said.

In 2017, Palo Alto Networks chief financial officer, as well as its head of sales in the Americas, departed.

This is a good trade as PANW is still growing top line and these short time headwinds should subside.

Stocks are volatile on the announcement of more American tariffs from China and the immediate retort by the administration that all American companies should leave China immediately.

Buy 26 September 2019 (PANW) $170 calls at………..….……$34.00

Sell short 26 September 2019 (PANW) $175 calls at………….$30.17

Net Cost:………………………….………..…………..................….....$3.83

Potential Profit: $5.00 - $3.83 = $1.17

(26 X 100 X $1.17) = $3,042 or 30.42% in 28 days.

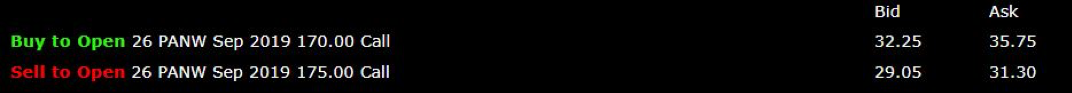

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.