Trade Alert - (SDS) April 15, 2020 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SDS) – TAKE PROFITS

SELL the 2X ProShares Ultra Short S&P 500 (SDS) at $25.64 or best

Closing Trade – NOT FOR NEW SUBSCRIBERS

4-15-2020

Portfolio weighting: decrease from 30% to 20%

Number of Shares = 400

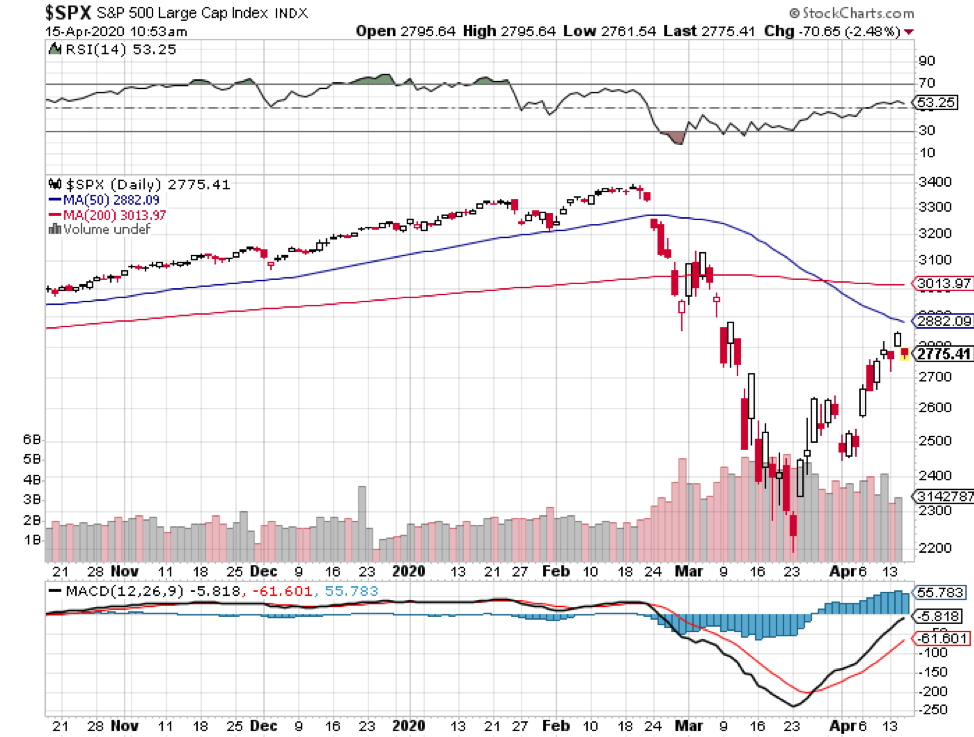

Stocks dove 700 points this morning on Trump’s move to defund the World Health Organization, blaming the international research institution for under reporting Chinese Corona cases.

The stunningly bad decision ensures the pandemic will be deeper and last longer, especially in poor countries where deaths will rise to the millions.

All faith in leadership at the top is gone during the defining crisis of this century.

I am going to be opportunistic and try and trade every big kneejerk market move, even though I believe we will move lower.

I am therefore selling the 2X ProShares Ultra Short S&P 500 (SDS) at $25.64 or best. We no longer have the long positions this trade was intended to hedge.

This was a bet that the S&P 500 would fall. It did.

Here is the specific trade you need to exit this position:

Sell 400 X (SDS) at………….……….....………………….……$25.64

Net Proceeds:………………………….………..………….….....$10,256

dollar cost = (400 X $25.64) = $10,256

Net profit: $10,256 - $10,040 = $216, or 2.15% for the model $10,000 portfolio.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.