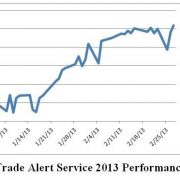

Trade Alert Service Clocks 26% Gain In 2013

The Trade Alert Service of the Mad Hedge Fund Trader has posted a 26.01% profit year to date, taking it to another new all time high. The 26-month total return has punched through to an awesome 81.06%, compared to a miserable 15% return for the Dow average during the same period. That raises the average annualized return for the service to 36%, elevating it to the pinnacle of hedge fund ranks.

My bet that the stock markets would move sideways to up small during the month of February has paid off big time, as I continued to run sizeable long positions in the S&P 500 and the Russell 2000 (IWM). In the end, the Dow gained only 80 points for the month, an increase of only 57 basis points. My substantial short volatility positions are contributing to profits daily. I booked nice profits from holdings in American International Group (AIG) and copper producer, Freeport McMoRan (FCX). I also prudently doubled up my short positions in the Japanese yen.

It has truly been a month where everything is working. Even my short positions in deep out of the money calls on the (SPY) are substantially contributing to my P&L. While the (SPY) has been going up, it has not been appreciating fast enough to hurt the position. In the meantime, I have been able to dodge the bullets that have been killing off other hedge funds, including those in gold (GLD), oil (USO), and commodities (CORN), (CU).

All told, the last 18 consecutive recommendations of the Trade Alert Service have been profitable. I have eight trades to go to beat this record. Watch this space.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service, daily newsletter, real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars. To subscribe, please go to my website at www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.