Trade Alert - (SNOW) February 29, 2024 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SNOW) – BUY

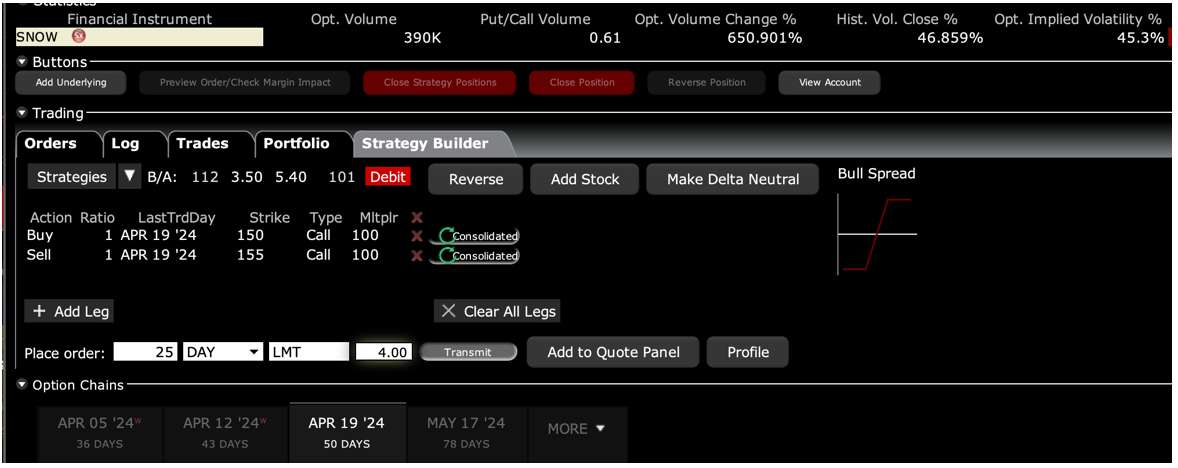

BUY the Snowflake (SNOW) April 2024 $150-$155 in-the-money vertical Bull Call spread at $4.00 or best

Opening Trade

2-29-2024

expiration date: April 19, 2024

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Not a day goes by when someone asks me for a good cloud company to invest in. Today, we have the best one out there selling at a 20% discount.

Snowflake is the preeminent cloud-based company out there. Yesterday, the CEO Frank Slootman announced he was retiring after delivering better-than-expected earnings but weak guidance. The dive has taken the implied volatility on (SNOW) options up to an incredible 46%, creating rich pickings for traders.

I am therefore buying the Snowflake (SNOW) April 2024 $150-$155 in-the-money vertical Bull Call spread at $4.00 or best.

Don’t pay more than $4.40 or you’ll be chasing on a risk/reward basis.

Snowflake Inc. is an American cloud computing-based data company based in Bozeman, Montana. It was founded in July 2012 and was publicly launched in October 2014.

The firm offers a cloud-based data storage and analytics service, generally termed "data-as-a-service". It allows corporate users to store and analyze data using cloud-based hardware and software. Snowflake service's main features are separation of storage and compute, on-the-fly scalable compute, data sharing, data cloning, and third-party tools support in order to scale with its enterprise customers.

This is a bet that Snowflake will not fall below $155 by the April 19 option expiration in 27 trading days.

Here are the specific trades you need to execute this position:

Buy 25 April 2024 (SNOW) $150 calls at………….……..$38.00

Sell short 25 April 2024 (SNOW) $155 calls at…………$34.00

Net Cost:………………………….……..…..…….….................$4.00

Potential Profit: $5.00 - $4.00 = $1.00

(25 X 100 X $1.00) = $2,500 or 25.00% in 35 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.