Trade Alert - (SNOW) March 11, 2024 - STOP LOSS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SNOW) – STOP LOSS

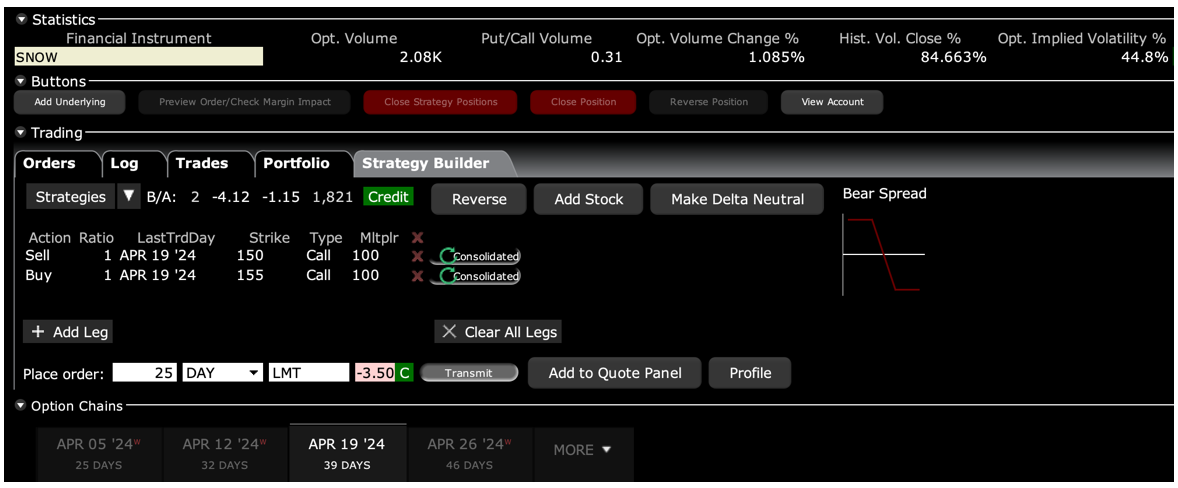

SELL the Snowflake (SNOW) April 2024 $150-$155 in-the-money vertical Bull Call spread at $3.50 or best

Closing Trade

3-11-2024

expiration date: April 19, 2024

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Given Friday’s dramatic reversal in NVIDIA (NVDA), I believe that the time to de-risk is at hand. Tech stocks are the most overbought in 25 years and risk is high.

I am not even going to wait until we hit the upper strike price in this spread to stop out of this position. It’s easier to dig yourself out of a small hole than a big one.

Further muddling the picture is the inflation data out this week. If it comes in, hot technology stocks will tank. (SNOW) is a great company to own for the long term. Short term we could be in for some additional volatility.

I am therefore selling the Snowflake (SNOW) April 2024 $150-$155 in-the-money vertical Bull Call spread at $3.50 or best.

Don’t enter a market order to sell on pain of death. Simply enter a limit order and adjust it down quickly if you don’t get done.

Not a day goes by when someone asks me for a good cloud company to invest in. Today, we have the best one out there selling at a 20% discount.

Snowflake is the preeminent cloud-based company out there. The CEO Frank Slootman announced he was retiring after delivering better-than-expected earnings but weak guidance. The dive has taken the implied volatility on (SNOW) options up to an incredible 46%, creating rich pickings for traders.

Snowflake Inc. is an American cloud computing-based data company based in Bozeman, Montana. It was founded in July 2012 and was publicly launched in October 2014.

The firm offers a cloud-based data storage and analytics service, generally termed "data-as-a-service". It allows corporate users to store and analyze data using cloud-based hardware and software. Snowflake service's main features are separation of storage and compute, on-the-fly scalable compute, data sharing, data cloning, and third-party tools support in order to scale with its enterprise customers.

This was a bet that Snowflake would not fall below $155 by the April 19 option expiration in 27 trading days.

Here are the specific trades you need to exit this position:

Sell 25 April 2024 (SNOW) $150 calls at………….……............…$18.00

Buy to cover short 25 April 2024 (SNOW) $155 calls at…..……$14.50

Net Proceeds:………………………….………..…….…........................$3.50

Loss: $4.00 - $3.50 = $0.50

(25 X 100 X $0.50) = $1,250.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.