Trade Alert - (SPY) #2 - January 14, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- TAKE PROFITS

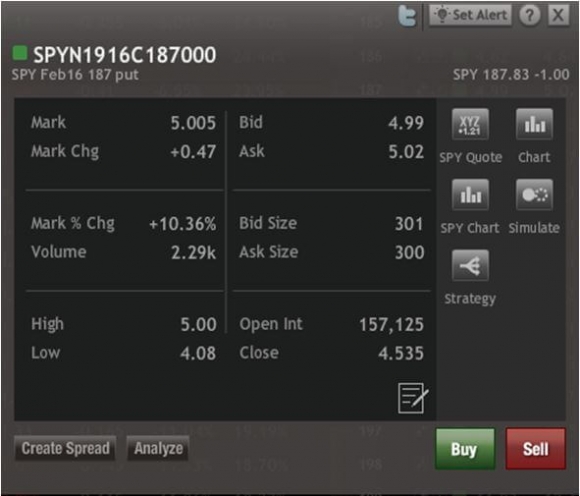

SELL the S&P 500 SPDR?s (SPY) February, 2016 $187 Puts at $5.00 or best

Closing Trade

1-14-2015

expiration date: February 19, 2016

Portfolio weighting: 5%

Number of Contracts = 14 contracts

The S&P 500 SPDR?s (SPY) February, 2016 $187 Puts did their job here. They hedged out most of the downside risk in our (SPY) January $185-$190 vertical bull call debit spread.

It certainly proved handy to have on Wednesday, when the stock market suffered an incredible $61 handle intraday reversal.

It also provided insurance against a flash crash, although one never occurred. You never complain when you buy fire insurance and your house doesn?t burn down.

Now that the (SPY) January $185-$190 vertical bull call debit spread is gone, there is no need to carry the additional risk of keeping the $190 puts. We have a huge profit here, which I would rather take. So I am selling the position.

I don?t want to run a big outright naked short here in the wake of such a calamitous decline in the S&P 500. Better to wait for the next $500 point short covering rally and reestablish higher up.

Don?t count on this happening every time. It was a case of the harder I work, the luckier YOU get.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options trade, please watch my training video by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the options in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep out-of-the-money options can be enormous.

Here is the specific trade you need to execute this position:

Sell 14 February, 2016 (SPY) $187 puts at????.?.??$5.00

Profit: ($5.00 - $3.50) = $1.50

($1.50 X 14 contracts X 100) = $2,100, or +2.10% for the notional $100,0000 model trading portfolio.

The Downside Protection That Worked

The Downside Protection That Worked