Trade Alert (SPY) #2 March 3, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY

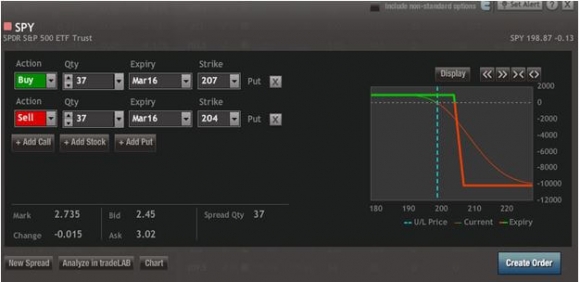

Buy the S&P 500 SPDR?s (SPY) March, 2016 $204-$207 in-the-money vertical bear put spread at $2.73 or best

Opening Trade

3-3-16

expiration date: March 18, 2016

Portfolio weighting: 10%

Number of Contracts = 37 contracts

You can pay all the way up to $2.80 for this spread and it still makes sense.

The S&P 500 SPDR?s (SPY) March, 2016 $204-$207 in-the-money vertical bear put spread is a bet that the (SPY) will close at or below $204 at the March 18 expiration, in ten trading days.

Note that the lower strike is well above the 200-day moving average, which should prove tough resistance on the way up.

The stock market has gone from extremely oversold to extremely overbought in a mere three weeks. It turns out that the world didn?t end after all.

I think that once the February nonfarm payroll on Friday and next week?s European Central Bank announcement on quantitative easing are out of the way, stocks will be ripe for a selloff.

If you can?t do the options, buy the ProShares Short S&P 500 Short Fund ETF (SH), or the ProShares Ultra Short S&P 500 Short Fund 2X ETF (SDS).

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 37 March, 2016 (SPY) $207 puts at????.?.??$9.30

Sell short 37 March, 2016 (SPY) $204 puts at.????..$6.57

Net Cost:???????????????????......$2.73

Potential Profit: $3.00 - $2.73 = $0.27

(37 X 100 X $0.27) = $999 or 0.99% profit for the notional $100,000 portfolio