Trade Alert - (SPY) April 21, 2022 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SPY) - BUY

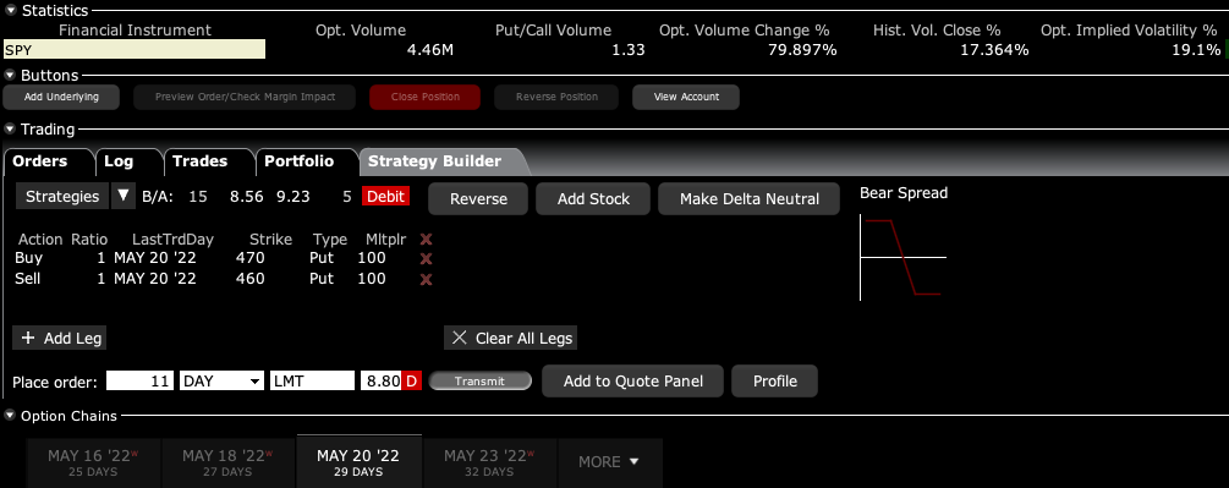

BUY the S&P 500 (SPY) May 2022 $460-$470 in-the-money vertical BEAR PUT spread at $8.80 or best

Opening Trade

4-21-2022

expiration date: May 20, 2022

Portfolio weighting: 10%

Number of Contracts = 11 contracts

I’m sorry, but I just don’t believe that the S&P 500 is going to a new all-time high in the next four weeks.

The S&P 500 (SPY) has just pulled off a respectable $15-point rally on really no news. It’s pure short covering.

Where is the next upside surprise from here? There aren’t any.

One can point to many downside surprises. And accelerated Fed schedule for interest rates hikes, a sooner than expected end to QE, a quantitative tightening (QT) that has been moved up, soaring oil prices would be among the many.

Did I mention war with Russia over the Ukraine?

The (SPY) has problems of its own in that it is a particularly technology-heavy index, some 28%, which is facing unique headlines of its own, such as lofty valuations.

I am therefore buying the S&P 500 (SPY) May 2022 $460-$470 in-the-money vertical BEAR PUT spread at $8.80 or best

Don’t pay more than $9.40 or you’ll be chasing.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

This is a bet that the S&P 500 (SPY) will not trade above $460.00 by the May 20 options expiration day in 21 trading days. That is up 20 (SPY) points from here.

If you don’t do options stand aside. This is a very short-term options expiration play only.

Here are the specific trades you need to execute this position:

Buy 11 May 2022 (SPY) $470 puts at………….………$39.00

Sell short 11 May 2022 (SPY) $460 puts at………….$30.20

Net Cost:……....…………………….………..………….….....$8.80

Potential Profit: $10.00 - $8.80 = $1.20

(11 X 100 X $1.20) = $1,320 or 13.63% in 21 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.