Trade Alert - (SPY) August 20, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (SPY)

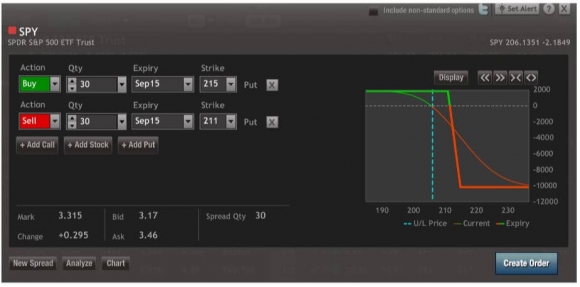

Buy the S&P 500 SPDR?s (SPY) September, 2015 $211-$215 in-the-money vertical bear put spread at $3.31 or best

Opening Trade

8-20-2015

expiration date: September 18, 2015

Portfolio weighting: 10%

Number of Contracts = 30 contracts

You can pay all the way up to $3.50 for this spread and it still makes sense. If you can?t do options, buy the ProShares Ultra Short S&P 500 2X ETF (SDS) instead (click here for a full fun description at http://www.proshares.com/funds/sds.html).

We have just broken through the 200-day moving average for the second time this week. This is not good.

The only thing that can derail this trade in coming weeks is a sudden monster stock rally in China. I am willing to bet against that.

In any case, I plan to be out of this baby well before the Federal Reserve interest rate decision on September 17.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 30 September, 2015 (SPY) $215 puts at????.??$10.50

Sell short 30 September, 2015 (SPY) $211 puts at????..?$7.19

Net Cost:?????????????????????.....$3.31

Potential Profit at expiration: $4.00 - $3.31 = $0.69

(30 X 100 X $0.69) = $2,070 or 2.07% profit for the notional $100,000 portfolio.