Trade Alert - (SPY) August 23, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY

Buy the S&P 500 SPDR?s (SPY) September, 2016 $222-$225 in-the-money vertical bear put spread at $2.68 or best

Opening Trade

8-23-2016

expiration date: September 16, 2016

Portfolio weighting: 10%

Number of Contracts = 37 contracts

Rising interest rates mean falling stock prices. And making downside stock index bets with 30 day realized volatility at a 20 year low is not a bad idea either.

That certainly was the lesson learned this past January, when a 25 basis point snugging triggered a 10% correction in the major stock indexes.

I don?t believe that we are in for another ten percent drop. Otherwise, I would be buying (SPY) puts outright here.

I do think 3%-4% is doable. And I plan to take profits quickly.

I still think we are in the midst of another leg of the bull market. However, stocks are overdue for a break, especially going into the September Fed meeting.

This IS the Diary of a Mad Hedge Fund Trader, not the Diary of a Mad Hedge Fund Long Term Investor.

You can pay all the way up to $2.75 for this spread and it still makes sense.

If you can?t do the options, buy the ProShares Short S&P 500 Short Fund ETF (SH) (click here for the prospectus at http://www.proshares.com/funds/sh.html), or the ProShares Ultra Short S&P 500 Short Fund 2X ETF (SDS) (click here for the prospectus at http://www.proshares.com/funds/sds.html). These are inverse ETFs which means they move in the opposite direction to the stock market.

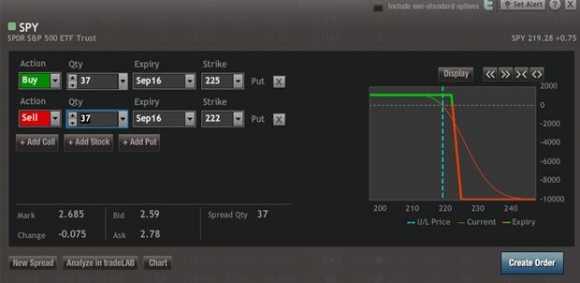

To see how to enter this trade in your online platform, please look at the order ticket below which I pulled off of optionshouse.

If you are uncertain about how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Debit Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 17 days to expiration.

Here are the specific trades you need to execute this position:

Buy 37 September, 2016 (SPY) $225 puts at????.?.??$6.88

Sell short 37 September, 2016 (SPY) $222 puts at.???.?..$4.20

Net Cost:???????????????????......$2.68

Potential Profit: $3.00 - $2.68 = $0.32

(37 X 100 X $0.32) = $1,184 or 11.94% profit in 17 trading days.