Trade Alert - (SPY) February 24, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY

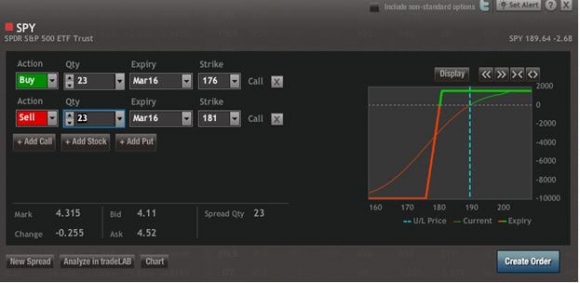

Buy the S&P 500 SPDR?s (SPY) March, 2016 $176-$181 in-the-money vertical bull call spread at $4.31 or best

Opening Trade

2-24-2016

expiration date: March 18, 2016

Portfolio weighting: 10%

Number of Contracts = 23 contracts

You can pay all the way up to $4.50 for this spread and it still makes sense.

If you can?t do options, buy the (SPY) outright on a much bigger dip.

The S&P 500 SPDR?s (SPY) February, 2016 $176-$181 in-the-money vertical bull call spread is a bet that the (SPY) won?t trade below $181 at the March 18 option expiration.

Note that is spare change below the $181.2 intraday spike low we put in on Thursday, February 11.

This hedges my long position in my (SPY) April $182 puts, which I am holding up my sleeve to use as flash crash insurance.

I think we have put in the lows AND the highs for stocks the first nine months of 2016.

Right here we could be about to create the right shoulder of a ?head and shoulders? bottom which could presage a bigger rally later in the year.

From here on, look for higher lows and lower highs until August, CREATING A GIGANTIC EIGHT-MONTH WEDGE FORMATION. Then we then start an upside breakout going into yearend.

If you want to know which sectors will lead, please go to my daily research newsletter Global Trading Dispatch.

LET ME POUND THIS INTO YOUR HEAD ONE MORE TIME!

THERE ISN?T GOING TO BE A RECESSION!

THE ECONOMIC DATA RELEASES ARE INSTEAD POINTING TO A REACCELEATION OF GROWTH IN THE CURRENT QUARTER TO POSSIBLY AS HIGH AS 3%.

Keep in mind there has NEVER been a recession in the face of low interest rates, low oil prices, and foreign economic weakness, AS WE HAVE NOW.

In a NIRP (negative interest rate policy) world, BLUE CHIP EQUITIES YIELDING 2%-5% ARE THE HIGH YIELD ASSETS OF OUR DAY!

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 23 March, 2016 (SPY) $176 calls at????.?.??$14.60

Sell short 23 March, 2016 (SPY) $181 calls at.????..$10.29

Net Cost:???????????????????......$4.31

Potential Profit: $5.00 - $4.31 = $0.69

(23 X 100 X $0.69) = $1,587 or 1.54% profit for the notional $100,000 portfolio