Trade Alert - (SPY) February 3, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY

Buy the S&P 500 SPDR?s (SPY) February, 2016 $173-$178 in-the-money vertical bull call spread at $4.52 or best

Opening Trade

2-3-2016

expiration date: February 19, 2016

Portfolio weighting: 10%

Number of Contracts = 22 contracts

You can pay all the way up to $4.75 for this spread and it still makes sense. If you can't do options stand aside too early to buy this market.

Right here, the S&P 500 SPDR?s (SPY) February, 2016 $173-$178 in-the-money vertical bull call spread is a very low risk, high return trade, with a February 19 expiration, just 12 trading days away.

With an expiration that short, the time decay on this one is highly accelerated.

The Volatility Index (VIX) finally popped above $27.50 this morning, so we can now earn descent profits buying very deep in-the-money vertical bull call spreads.

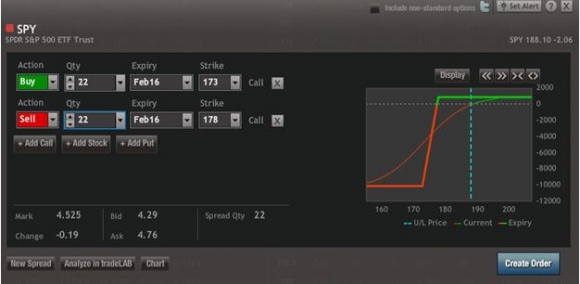

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 22 February, 2016 (SPY) $173 calls at????.?.??$15.50

Sell short 22 February, 2016 (SPY) $178 calls at.????..$10.98

Net Cost:???????????????????......$4.52

Potential Profit: $5.00 - $4.52 = $0.48

(22 X 100 X $0.48) = $1,056 or 1.0% profit for the notional $100,000 portfolio