Trade Alert - (SPY) November 2, 2016

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

?

Trade Alert - (SPY) - STOP LOSS

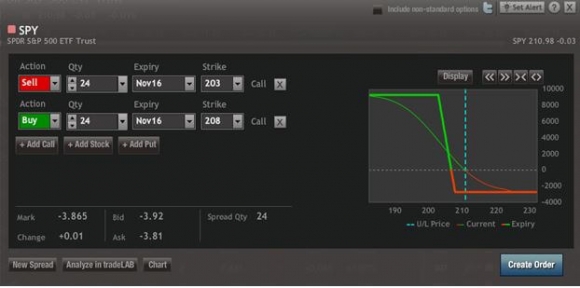

SELL the S&P 500 SPDR (SPY) November, 2016 $203-$208 in-the-money vertical bull call spread at $3.86 or best

Closing Trade

11-2-2016

Expiration Date: November 18, 2016

Portfolio Weighting: 10%

Number of Contracts = 24 contracts

I am up 22% on the year.

I like being up 22% on the year, and I want to stay up 22% or more.

I am pulling this off in the worst trading year in hedge fund history, beating funds that have hundreds of in-house analysts.

So, I am therefore going to stick to my strict stop loss discipline and bail out here on my position in the S&P 500 SPDR (SPY) November, 2016 $203-$208 in-the-money vertical bull call spread for a small loss.

The pinprick inflicted by this trade is more than amply offset by the large gains I took in with my hedges in short positions in the S&P 500 (SPY), the Russell 2000 (IWM), oil (USO), US Treasury bonds (TLT) and my long in gold (GLD).

This puts me in the enviable position of going into the November 8th presidential election entirely in cash. That has been my goal for all of 2016.

And I go into this cash position coming off an absolute tear in trading performance, making an eye popping 8.13% in October, enduring a flat September, and taking in a whopping 7.52% in August.

Those lucky ones who bought my service in July must think I?m some kind of genius.

I?m not. I just work very hard and love what I do.

Cash has an option value, and by maximizing my cash here I am creating the maximum amount of dry powder going into an extreme risk event, one of the biggest in a decade.

I think Hillary Clinton has the Electoral College locked up. It is mathematically impossible for Trump to win.

Of the 13 battle ground states, Clinton is winning 10 by large margins and breaking even in three. It is an insurmountable lead.

And Clinton has 50,000 ground troops to get out the vote which Trump lacks.

Absentee voting in Hispanic neighborhoods across the country is coming in at levels 100% higher than in the last election.

Donald Trump finally pulled off what Democrats have never able to do on their own: get Hispanics to vote in large numbers for Democrats.

Even the betting polls are showing 70-30 odds in Clinton?s favor.

I have another poll to refer to that is even more valuable.

Of the 6,000 followers in all 50 US states and 135 countries who read the Diary of a Mad Hedge Fund Trader on a daily basis, I know of only two who are voting for Donald Trump.

After all, this is an educated, pragmatic, and opportunistic group who are primarily interested in making money.

Of the two who are voting for Trump, one is a hard core conservative in Arkansas who is still fighting the Civil War (yes, that?d be you, Rufus!).

The other, in Oklahoma, believes in every Internet conspiracy theory that comes along, no matter how frequently they are proven wrong.

But I would rather read about the election outcome in the newspapers than in my portfolio. This is how you get to stay in the game for 50 years, as I have.

By the way, the last time I took the portfolio to 100% cash was going into the Brexit vote.? That worked out pretty well.

The goal here is not to be right, feel good, or seize the moral high ground. It is about earning absolute positive returns at all times.

THIS IS HOW YOU DO IT!

Having said all that, and being out of the market, I?m now headed off to the Incline Village, Nevada Public Library to vote early. Nevada is a battleground state, and every vote will count, even mine.

I hear it?s going to be crowded on election day.

To see how to enter this trade in your online platform, please look at the order ticket below which I pulled off of OptionsHouse.

If you are uncertain about how to execute this options spread, please watch my training video How to Execute a Vertical Bull Call Spread

Please keep in mind these are ballpark prices at best. After the text alerts go out, prices can be all over the map. There is no telling how much the market will have moved by the time you get this email.

Paid subscribers, be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's volatile markets, individual investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile with only 12 days to expiration.

Here Are the Specific Trades You Need to Execute This Position:

Sell 24 November, 2016 (SPY) $203 calls at????.?.??$9.20

Buy to cover short 24 November, 2016 (SPY) $208 calls at...$5.34

Net Proceeds:??????????????????......$3.86

Loss: $4.26 - $3.86 = -$0.40

(24 X 100 X $0.40) = -$960 or -9.39% loss.