Trade Alert - (SPY) September 1, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (SPY)- BUY

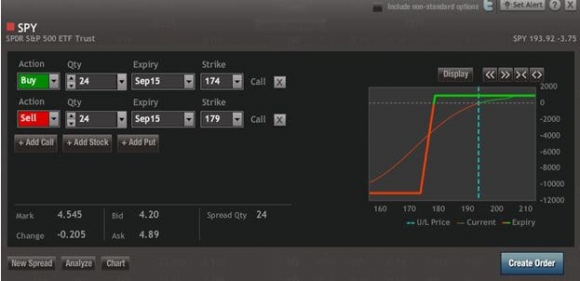

Buy the S&P 500 SPDR?s (SPY) September, 2015 $174-$179 in-the-money vertical bull call spread at $4.54 or best

Opening Trade

9-1-2015

expiration date: September 18, 2015

Portfolio weighting: 10%

Number of Contracts = 24 contracts

You can pay all the way up to $4.70 for this spread and it still makes sense. If you can?t do options, buy the S&P 500 shares outright for a long-term hold.

It is a bet that the (SPY) does not trade below $178.46 in the next 12 trading days. That is 7.82% below here, and 16.6% below the recent high. It is even $4 points below the October, 2014 crash low, the number we are clearly trading against.

Keep in mind that we have ?fast trading? conditions now, so the prices can be anywhere.

With the Volatility Index (VIX) trading at $31, I?ll take that as a ?BUY? signal. With volatility this high, trades that are seemingly impossible can get done. This is one of those ?Mission Impossibles.?

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 24 September, 2015 (SPY) $174 calls at????.??$20.70

Sell short 24 September, 2015 (SPY) $179 calls at????..?$16.16

Net Cost:?????????????????????.....$4.54

Potential Profit at expiration: $5.00 - $4.54 = $0.46

(24 X 100 X $0.46) = $1,104 or 1.10% profit for the notional $100,000 portfolio