Trade Alert - (SPY) September 24, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (SPY)- BUY

?RISK ON?

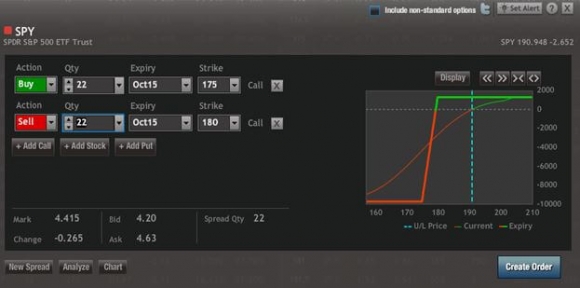

Buy the S&P 500 SPDR?s (SPY) October, 2015 $175-$180 in-the-money vertical bull call spread at $4.41 or best

Opening Trade

9-24-2015

expiration date: October 16, 2015

Portfolio weighting: 10%

Number of Contracts = 22 contracts

You can pay all the way up to $4.60 for this spread and it still makes sense. If you can't do options stand aside.

It is a bet that the (SPY) does not trade below $180 in the next 16 trading days. That is down 11 full points from here.

Keep in mind that we have ?fast trading? conditions now, so the prices can be anywhere.

With the Volatility Index (VIX) trading at $25, I?ll take that as a ?BUY? signal. With volatility this high, trades that are seemingly impossible can get done.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 22 October, 2015 (SPY) $175 calls at????.??$16.80

Sell short 22 October, 2015 (SPY) $180 calls at????..?$12.39

Net Cost:?????????????????????.....$4.41

Potential Profit at expiration: $5.00 - $4.41 = $0.59

(22 X 100 X $0.59) = $1,298 or 1.30% profit for the notional $100,000 portfolio