Trade Alert - (STX) September 3, 2019 - SELL-STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Trade Alert - (STX) – SELL – STOP LOSS

Sell the Seagate Technology plc (STX) September 2019 $50-$55 in-the-money vertical BEAR PUT spread at $3.96 or best

Closing Trade

9-3-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 22 contracts

Out of the 8 current positions in the portfolio, this was is the only one even close to life support.

This short position went against us on Friday, mushrooming 5% and the stock has gone up in a straight line from $44, clearing out our $50 strike price and churning all the way to $51 by Friday’s end.

The price action has been nothing short of horrific.

After the position ended Friday down 24%, I’ll use this drop of over 2% in the stock to exit the position with a small loss.

STX only has a 52.86% chance of ending below $50 by the expiration on September 20th and executing appropriate risk control now is the only way to keep the portfolio healthy.

When someone gives you a gift, take it with both hands.

I still hate the company and I urge readers to avoid holding this stock long term.

There are tons of better fishes in the sea.

Seagate Technology is a legacy tech company who each time gets a bump in shares because they are doing less worse than previous thought.

Seagate Technology PLC shares fell on last earnings report because the maker of hard disk drives and storage products said revenue fell in its fiscal fourth quarter and offered soft profit guidance.

Labels like “deep value” are not what I want to hear at this stage in the economic cycle.

The company hasn’t grown revenue in years and the global slowdown won’t help them overcome softness and the weak guidance confirmed that.

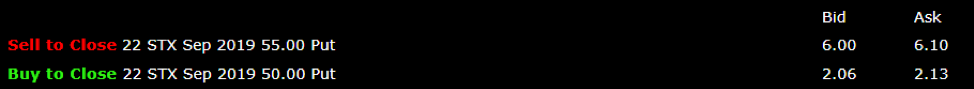

Here are the specific trades you need to execute this position:

Sell 22 September 2019 (STX) $55 put at………….……......…$6.05

Buy to cover short 22 September 2019 (STX) $50 put at….$2.09

Net Proceeds:……………………..…….………..……....................$3.96

Loss: $4.50 - $3.96 = $0.54

(22 X 100 X $0.54) = $1,188 or 11.88%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.