Trade Alert - (TLT) April 11, 2019 - TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – SELL – TAKE PROFITS

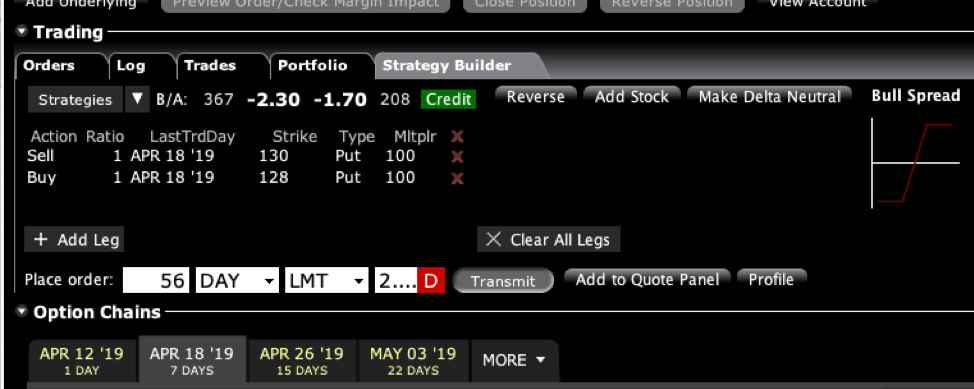

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) April 2019 $128-$130 in-the-money vertical BEAR PUT spread at $1.99 or best

Closing Trade – NOT FOR NEW SUBSCRIBERS

4-11-2019

expiration date: April 18, 2019

Portfolio weighting: 10%

Number of Contracts = 56 contracts

We have pretty much sucked the marrow out of this trade, with 95.45% of the maximum potential profit in hand. The middle market is showing $2.00 this morning, so I’ll give you a penny to get this done.

So, I am selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) April 2019 $128-$130 in-the-money vertical BEAR PUT spread at $1.99 or best.

If you can’t get done at $1.99, cancel your order, lower your offer a penny at a time until you get done. Alternatively, you run the position into the April 18 option expiration in six trading days to get the full $2.00. It would take a 9/11 type event for this position to expire out-of-the-money by then.

By coming out here, you earned a handy $1,176 or 11.79% in only 10 trading days. Our timing on this one was perfect, capturing nearly three points on the downside from the spike to $126 two weeks ago.

This was a bet that the (TLT) would not rise above $128.00 by the April 18 expiration day in 14 trading days. That would require ten-year US Treasury bonds to fall below 2.30%, a three-year low, versus the current 2.46%. That was highly unlikely, given all the stimulus that is out there in the economy.

The fundamental reasons for this trade are growing by the day.

1) Resolution of the China trade war will provide a short burst of economic growth, even if it doesn’t happen soon. The Mueller Report will increase the chances this gets done sooner than later.

2) The Fed is dropping on the bond market $50 billion a month, or $1.70 billion a day worth of paper in its QE unwind until September.

3) Massive Tax cuts for corporations are still providing further stimulus for the US economy.

4) With the foreign exchange markets now laser-focused on America’s exploding deficits and fading interest rate picture, a weak US dollar has triggered a capital flight out of the US.

5) We also now have evidence that China has started to dump its massive $1 trillion in US Treasury bond holdings.

All are HUGELY bond negative.

If you don’t do options, this would be a great level to scale into a long in the ProShares Ultra Short 20+ Treasury Bond Fund (TBT), a bet that bonds will fall.

Here are the specific trades you need to execute this position:

Sell 56 April 2019 (TLT) $130 puts at……..............…….………$6.60

Buy to cover short 56 April 2019 (TLT) $128 puts at………….$4.61

Net Cost:………………………….………...............…..………….….....$1.99

Profit: $1.99 - $1.78 = $0.21

(56 X 100 X $0.21) = $1,176 or 11.79% in 14 trading days.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.