Trade Alert - (TLT) August 23, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (TLT)- BUY

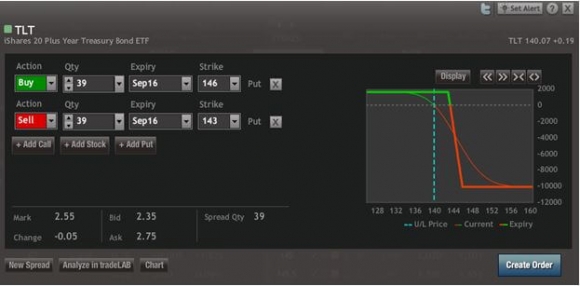

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) September, 2016 $143-$146 in-the-money vertical bear put spread at $2.55 or best

Opening Trade

8-23-2016

expiration date: September 16, 2016

Portfolio weighting: 10%

Number of Contracts = 39 contracts

This is a bet that the ten-year Treasury bond won?t dip below 1.35% by September 16, in 17 trading days, from the current 1.55%. With the Fed at the beginning of a rate rising cycle, I think that is highly unlikely.

1.35% would represent a couple basis points above an all time low in Treasury bonds yields, and was last pegged when the prospect of a Fed tightening was uncertain, at best.

It's also a bet that the (TLT) will close below $143 on September 16.

You can pay all the way up to to $2.70 for this spread and this trade still makes sense.

If you can?t trade options, buy the ProShares Ultra Short 20 Year + Treasury ETF (TBT). It is safe to come out of your bunker now. You can make a lot of money trading a $30-$35 range. Buy long dated calls, call spreads, and do buy writes.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Spread? by clicking here at

http://www.madhedgefundtrader.com/ltt-vbpds/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 39 September, 2016 (TLT) $146 puts at????.???$6.25

Sell short 39 September, 2016 (TLT) $143 puts at..????.$3.70

Net Cost:????????????????..??.?.....$2.55

Potential Profit: $3.00 - $2.55 = $0.45

(39 X 100 X $0.45) = $1,755 or 17.65% profit over the next 17 trading days.