Trade Alert - (TLT) January 15, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (TLT)- BUY

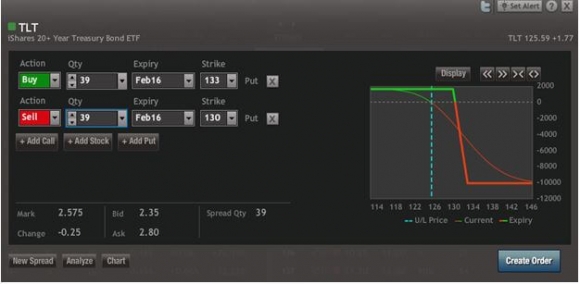

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) February, 2016 $130-$133 in-the-money vertical bear put spread at $2.57 or best

?RISK ON?

Opening Trade

1-15-2016

expiration date: February 19, 2016

Portfolio weighting: 10%

Number of Contracts = 39 contracts

There is a huge flight to safety rush into the Treasury bond (TLT) market this morning, which should be a temporary affair, at best.

I am going to double up my Treasury bond short by adding the iShares Barclays 20+ Year Treasury Bond Fund (TLT) February, 2016 $130-$133 in-the-money vertical bear put spread.

You can pay all the way up to $2.70 for this spread and it still makes sense.

If you can?t trade options, then buy the ProShares Ultra Short Treasury Bond Fund ETF (TBT) outright. I think $40 is going to hold, and the upside target is $47.

This is a bet that the ten-year Treasury bond won?t dip below 1.75% by February 19, from the current 2.01%. With the Fed at the beginning of a rate rising cycle, I think that is highly unlikely.

1.75% is below the yield we saw for a few nanoseconds during the August 24 flash crash.

For the many (TBT) followers out there, the coast is clear. It is safe to come out of your bunker now. You can make a lot of money trading a $41-$48 range.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Vertical Bear Put Spread? by clicking here at

http://www.madhedgefundtrader.com/ltt-vbpds/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 39 February, 2016 (TLT) $133 puts at????.???$11.80

Sell short 39 February, 2016 (TLT) $130 puts at..????.$9.23

Net Cost:????????????????..??.?.....$2.57

Potential Profit: $3.00 - $2.57 = $0.43

(39 X 100 X $0.43) = $1,677 or 1.68% profit for the notional $100,000 portfolio.