Trade Alert - (TLT) June 6, 2022 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – TAKE PROFITS

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) July 2022 $128-$131 in-the-money vertical Bear Put spread at $2.90 or best

Closing Trade

6-6-2022

expiration date: July 15, 2022

Portfolio weighting: 10%

Number of Contracts = 40 contracts

I had planned to hold this position until the July 15 expiration date. However, since I added this position, ten trading days ago, the (TLT) has plunged by $6 and we now have 80% of the maximum potential profit in hand.

In addition, my Mad Hedge Market Timing Index has just jumped from 6 to 32. I like to have some cash on hand in case we get another meltdown and the Volatility Index (VIX) jumps from today’s $25 back above $35.

The risk/reward of continuing for 25 more trading days is no longer favorable.

I am therefore selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) July 2022 $128-$131 in-the-money vertical Bear Put spread at $2.90 or best.

By coming out here, you get to take home $1,600, or 16.00% in ten trading days.

Well done and on to the next trade! With this trade, we are now up an eye-popping 44.26% so far in 2022.

To lose money on this trade, the ten-year US Treasury yield would have to drop from 2.73% to below 2.33% in seven weeks, which was highly unlikely. Instead, we rose to 3.01%.

Treasury bonds have in fact been in a steep downtrend that began in end of November. I expect it to accelerate in the aftermath of the release of the Core Inflation Rate on June 10.

People are not taking a 3.01% yield on the ten-year US Treasury bond against an 8.1% inflation rate generating a negative -5.01% real yield because they think it’s a great deal.

The long-term outlook for fixed income is absolutely awful. The next big rotation in the markets will be for tech and financials to bounce hard off a bottom. This will result from coming major upgrades in economic growth, which analysts and strategists are wildly underestimating.

As soon as everyone gets the parts and labor they want, it is going to be off to the races. Add to that a Fed quantitative tightening on monetary stimulus and interest rates will soar.

With 2022 the Fed on an announced path of at least 200-basis point in interest rate rises, there is no chance you’ll see a major rally in the US Treasury bond market from here. The only question is how fast it will fall.

This was a bet that the (TLT) would not rise above $128.00 by the July 15 option expiration in two months.

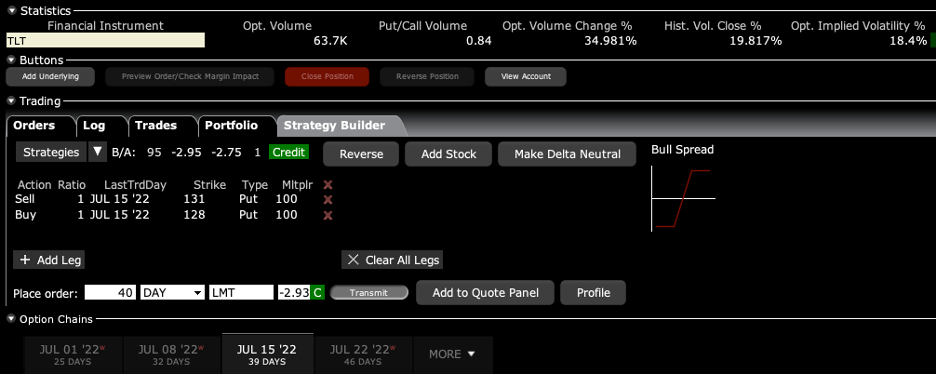

Here are the specific trades you need to exit this position:

Sell 40 July 2022 (TLT) $131 puts at……...........…….………$17.00

Buy to cover short 40 July 2022 (TLT) $128 puts at......…$14.10

Net Proceeds:……………................……………..………….….....$2.90

Profit: $2.90 - $2.50 = $0.40

(40 X 100 X $0.40) = $1,600, or 16.00% in ten trading days.

The Fat Lady is Singing for the Bond Market

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.