Trade Alert - (TLT) March 30, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – BUY

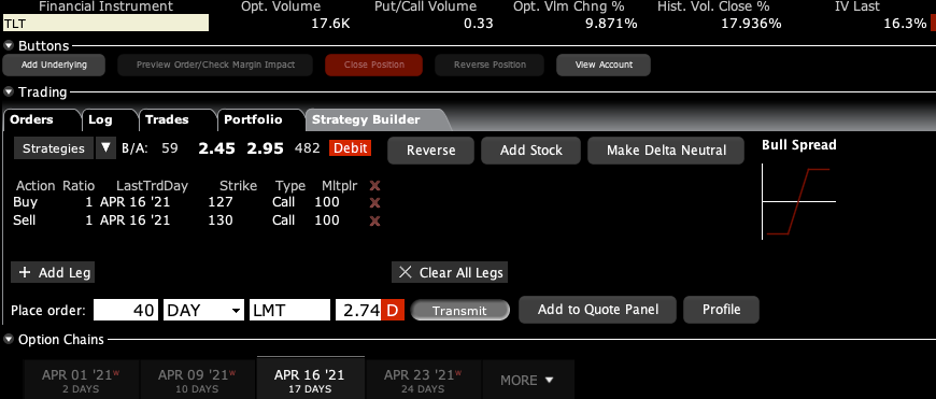

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) April 2021 $127-$130 in-the-money vertical Bull Call spread at $2.60 or best

Opening Trade

3-30-2021

expiration date: April 16, 2021

Portfolio weighting: 10%

Number of Contracts = 40 contracts

If you don’t play options, just stand aside. This is a short-term options expiration play only.

We have just sold off a respectable $3.00 from last week’s high for the (TLT), and a monster $25 since the beginning of 2021. That has taken ten-year US Treasury yields down from 0.89% to 1.76% in three months.

While I’m certain that bonds will hit a 2.00% yield this year, they’re not going to do so in the next two weeks. Upside momentum in yields from here will slow.

In any case, with the Volatility Index (VIX) at $18 right now, and the Mad Hedge Market Timing Index stuck around a neutral 50, there are few short term trading opportunities in the market these days.

So, let’s go for the sofa change.

I am therefore going to buy the iShares Barclays 20+ Year Treasury Bond Fund (TLT) April 2021 $127-$130 in-the-money vertical bull call spread at $2.60 or best

Don’t pay more than $2.75 or this is really not worth doing.

This new position is partially hedged by our existing double short positions higher up where we are amply in the money.

The memo is out now. Bonds have already dropped $25 in 2021 and the worst is yet to come. This is becoming a one-way trade. Therefore, I will be selling even small rallies, like the one we just saw.

With 2021 expected to be one of the strongest years for economic growth in history, there is no chance you’ll see a major rally in the US Treasury bond market from here. The only question is how fast it will fall.

The fundamentals of this trade are very simple. The national debt rose from a record $23 trillion to an eye-popping $28 trillion in 2020. In 2021 it is expected to explode to $32 trillion. The US Treasury demands on the bond market are going to be incredible.

It is almost mathematically impossible for bond prices to rise substantially from here. They can only go sideways at best, or down big in the worst case. Sounds like a great short to me.

This is a bet that the (TLT) will not fall below $130.00 by the April 17 option expiration in 13 trading days. To lose money on this position ten-year US Treasury yields would have to rocket to 2.00% from the current 1.76%, which they won’t do in 13 trading days.

Here are the specific trades you need to execute this position:

Buy 40 April 2021 (TLT) $127 calls at………….………$8.50

Sell short 40 April 2021 (TLT) $130 calls at…………$5.90

Net Cost:………………………….……...…..………….….....$2.60

Potential Profit: $3.00 - $2.60 = $0.40

(40 X 100 X $0.40) = $1,600 or 16.00% in 13 trading days.

The Fat Lady is Singing for the Bond Market

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.