Trade Alert - (TLT) March 5, 2021 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – TAKE PROFITS

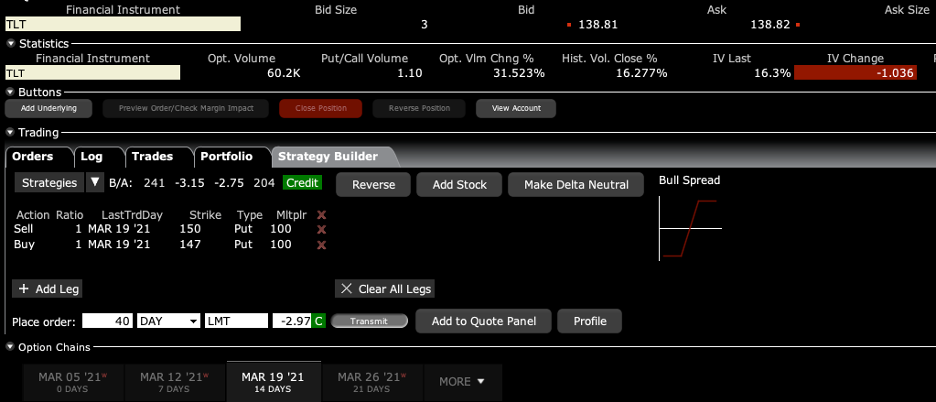

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) March 2021 $147-$150 in-the-money vertical Bear Put spread at $2.97 or best

Closing Trade - NOT FOR NEW SUBSCRIBERS – YOUR TURN WILL COME

3-5-2021

expiration date: March 19, 2021

Portfolio weighting: 10%

Number of Contracts = 40 contracts

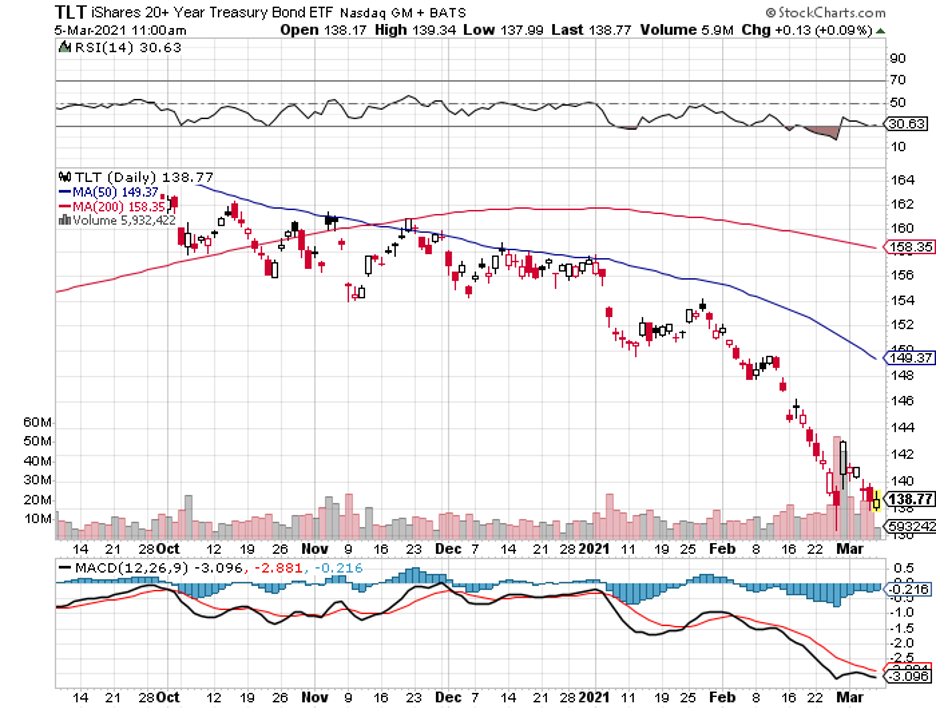

I’ll take the home run here so I can roll my cash into a new position. With only ten days left until the March 19 expiration, today is our last chance to take advantage of a $30 Volatility Index (VIX).

We can see a rip-your-face-off rally in bonds at any time, as the entire world is now short. With 92.5% of the maximum potential profit in hand, the risk/reward is no longer favorable.

I am therefore selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) Marcgh 2021 $147-$150 in-the-money vertical Bear Put spread at $2.97 or best.

Try as it may, the bond market just can’t get any more upside traction than that. Instead, we are getting a sideways “time” correction before the next down leg ensues. The outlook for fixed income is absolutely awful.

The memo is out now. The (TLT) has already dropped $25 in 2021 and the worst is yet to come. This is becoming a one-way trade. Therefore, I will be selling even small rallies, like the one we just saw.

With 2021 expected to be one of the strongest years for economic growth in history, there is no chance you’ll see a major rally in the US Treasury bond market from here. The only question is how fast it will fall.

The fundamentals of this trade are very simple. The national debt rose from a record $23 trillion to an eye-popping $28 trillion in 2020. In 2021 it is expected to explode to $32 trillion. The US Treasury demands on the bond market are going to be incredible.

It is almost mathematically impossible for bond prices to rise substantially from here. They can only go sideways at best, or down big in the worst case. Sounds like a great short to me.

This was a bet that the (TLT) would not rise above $147.00 by the March 19 option expiration in 14 trading days. To lose money on this position, ten-year US Treasury yields would have to plunge to 0.85% from the current 1.04%, which they won’t in a month.

Here are the specific trades you need to exit this position:

Sell 40 March 2021 (TLT) $150 puts at……….............….………$11.00

Buy to cover short 40 March 2021 (TLT) $147 puts at…….……$8.03

Net Proceeds:…………………………............………..…………..….....$2.97

Profit: $2.97 - $2.60 = $0.37

(40 X 100 X $0.37) = $1,480 or 14.23% in 14 trading days.

The Fat Lady is Singing for the Bond Market

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.