Trade Alert - (TLT) November 6, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (TLT)- TAKE PROFITS

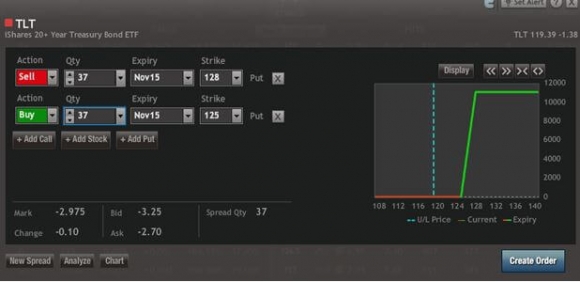

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) November, 2015 $125-$128 in-the-money vertical bear put spread at $2.97 or best

Closing Trade

11-6-2015

expiration date: November 20, 2015

Portfolio weighting: 10%

Number of Contracts = 37 contracts

Take the home run.

By betting that today?s October nonfarm payroll would come in better than expected, you have clocked a 10% profit in four trading days in the iShares Barclays 20+ Year Treasury Bond Fund (TLT) November, 2015 $125-$128 in-the-money vertical bear put spread.

Within nanoseconds of the announcement, the Treasury bond market (TLT) suffered one of the largest losses of the year, down some 2 FULL points.

Nice place to be short. WELL DONE!

At the current price you have reaped 90% of the maximum potential profit in this spread. The risk/reward does not favor carrying the position for two more weeks just to grab the last three cents.

As my late mentor, Morgan Stanley?s Barton Biggs used to tell me, ?Always leave the last 10% of a move for the next guy.?

So, TAKE THE MONEY AND RUN!

If you can?t get the $2.97 price immediately, stick to your guns. Just leave the limit order for the spread in until it gets done. There is zero chance the (TLT) can recover the $125 strike before the November 20 expiration.

I will be writing at length about the implications of today?s blockbuster nonfarm payroll print of 271,000 in a Trade Alert Update within the hour.

For the many (TBT) followers out there, the coast is clear. It is safe to come out of your bunker now. You can make a lot of money trading a $41-$48 range. Take profits for the short term, but hold for the medium and long term.

As a result, the US Treasury bond market appears within a hair?s breadth of breaking down from its recent range.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 37 November, 2015 (TLT) $128 puts at????.?.??$8.80

Buy to cover short 37 November, 2015 (TLT) $125 puts a?.$5.83

Net Cost:???????????????????.?.....$2.97

Profit: $2.97 - $2.70 = $0.27

(37 X 100 X $0.27) = $999 or 0.99% profit for the notional $100,000 portfolio.