Trade Alert - (TLT) October 2, 2015

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (TLT)- BUY

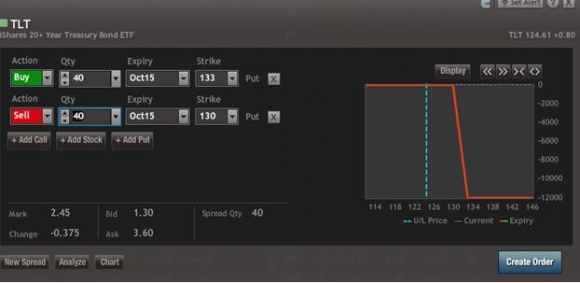

BUY the iShares Barclays 20+ Year Treasury Bond Fund (TLT) October, 2015 $130-$133 in-the-money vertical bear put spread at $2.45 or best

Opening Trade

10-2-2015

expiration date: October 16, 2015

Portfolio weighting: 10%

Number of Contracts = 40 contracts

You wanted a rally to sell bonds into? This is a rally and a half.

You can pay all the way up to $2.70 for this spread and it still makes sense. If you can?t trade options, then buy the ProShares Ultra Short Treasury Bond Fund ETF (TBT) outright. I think $41 is going to hold.

It is a bet that the (TLT) does not trade above $130 in the next 9 trading days.

It is also a bet that the yield on the ten-year Treasury bond does not fall below 1.70% during this time, a multiyear low.

Keep in mind that we have ?fast trading? conditions now, so the prices can be anywhere.

I have no idea where this spread is actually trading.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Buy 40 October, 2015 (SPY) $133 puts at????.?.??$7.50

Sell short 40 October, 2015 (SPY) $130 puts at..????.$5.05

Net Cost:??????????????????.?.....$2.45

Potential Profit: $3.00 - $2.45 = $0.55

(40 X 100 X $0.55) = $2,200 or 2.20% profit for the notional $100,000 portfolio.