Follow Up to Trade Alert - (TLT) October 7, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price. This is your chance to ?look over? John Thomas? shoulder as he gives you unparalleled insight on major world financial trends BEFORE they happen.

Trade Alert - (TLT)- UPDATE

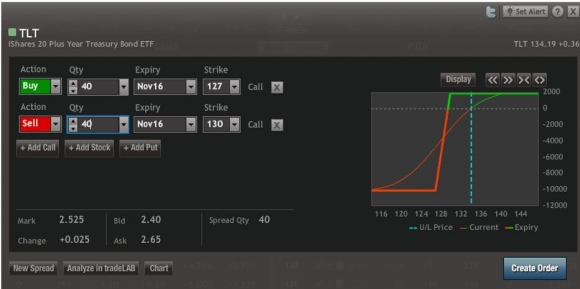

BUY the iShares 20+ Year Treasury Bond ETF (TLT) November, 2016 $127-$130 in-the-money vertical bull call spread at $2.52 or best

?Opening Trade

10-7-2016

Expiration Date: November 18, 2016

Portfolio Weighting: 10%

Number of Contracts = 40 contracts

Another nail was driven into the coffin for the December Fed rate rise on Friday.

That is the undeniable conclusion derived from the tepid September Non Farm Payroll Report at 156,000. The headline unemployment rate ticked up slightly to 5.0%.

The Fed tells us every day that it is data driven, and this number certainly does NOT scream that the economy is overheating and urgently needs to be reigned back.

What does all of this means for the markets?

It confirms my view that all asset classes will continue to churn sideways in narrow ranges for another month going into the election.

With the media bombarding us nonstop daily with election bombast, nobody wants to stick their neck out and front run the outcome.

Except, that is, me.

I did use the opportunity to double my long position in the US Treasury bond market while it was trading at the bottom of a four-month range.

The strike prices I am using assume that the yield on the ten-year Treasury bond won?t rise above 2.03% over the next six weeks, a bet that I am quite happy to make.

In our relentlessly deflationary world bond markets will continue to shock traders, investors, and financial advisors with ultra low yields.

YOU CAN PAY UP TO $2.60 FOR THIS POSITION AND IT STILL MAKES SENSE.

It is a bet that the (TLT) will not trade below the $130 level by the November 18 expiration date in 30 trading days.

If you can?t trade options, buy the (TLT) for a quick trading bounce.

With the (TLT) down 6 points in a week, I think the US Treasury bond market has suffered enough.

Having caught the entire move on the short side, I am now going to play from the long side.

In a week, 10-year yields have jumped from 1.54% to 1.78%. or some 24 basis points.

To lose money on the iShares 20+ Year Treasury Bond ETF (TLT) November, 2016 $127-$130 in-the-money vertical bull call spread the yield would have to rocket another 25 basis points to 2.03%, a six month high, or 49 basis points from the recent low.

It?s not going to happen.

In other words, a 25 basis point rate rise is already entirely discounted in the market at today?s levels.

Given the most that the Fed is going to raise rates at their mid December meeting is 25 basis points, and that there is now less than a 50% chance of that happening, this is already factored in.

So there?s your trade. The (TLT) should bottom out around here and stage a brief rally.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain about how to execute an options spread, please watch my training video How to Execute a Vertical Bull Call Spread

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Please keep in mind these are ballpark prices at best. After the text alerts go out, prices can be all over the map. There is no telling how much the market will have moved by the time you get this email.

Paid subscribers, be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage.? In today's volatile markets, individual investors need every advantage they can get.

Here Are the Specific Trades You Need to Execute This Position:

Buy 40 November, 2016 (TLT) $127 calls at????.???$7.50

Sell short 40 November, 2016 (TLT) $130 calls at???..?.$4.98

Net Cost:????????????????..??.?.....$2.52

Potential Profit: $3.00 - $2.52 = $0.48

(40 X 100 X $0.48) = $1,920 or 19.04% in 30 trading days.